VC Funding for Innovation has changed a huge amount from the early VCs in the 1980. Listen to this podcast from The Economist “Money Talks” 2021 Sept Veni, vidi, VC—the new age of venture capital. In this podcast, they talk about how venture capital is no longer in the Silicon Valley investing in its own backyard but a new wave of both capital and competition is powering new ideas across sectors and around the world, whether in Europe, Israel, or New Zealand or Australia.

Bottom line – in this age of bonds and interest at close to zero, with trillions of funds held, innovative businesses have provided returns of over 30% and it is too attractive not to place funds into alternate investments.

Why the Huge Increase in VC Funding for Innovation?

- Rapid rate of companies going public has provided – huge valuation of these and this has created a wave of new cash.

- More and more money moving into venture capital due to lower returns of bonds. There is an estimated $16 trillion sitting in negative yields

- Not demand driven but supply driven says Rudulpth Botha from Sequoia Capital

- Sheer bottom up innovation – in 2000, at the start of PayPal, there were 200 million peopel with internet, now billions with high speed.

- In 2002, the number of public billion dollar technology companies was 368. Now there are over 1200

- In 2002, there were 59 companies worth over $10 billion, and now there are 267 companies.

- Technology infusing so many sectors

- The original 3 of the top 10 equity businesses were the conventional type, but now there are many new private equity firms.

- Nature hates a vaccumm. In 2002, the returns were returns terrible, now is huge opotunity high

- In 15 years ago, 80% of VC funds were in Silicon valley, now over 50% is outside of the USA.

- Business partnership

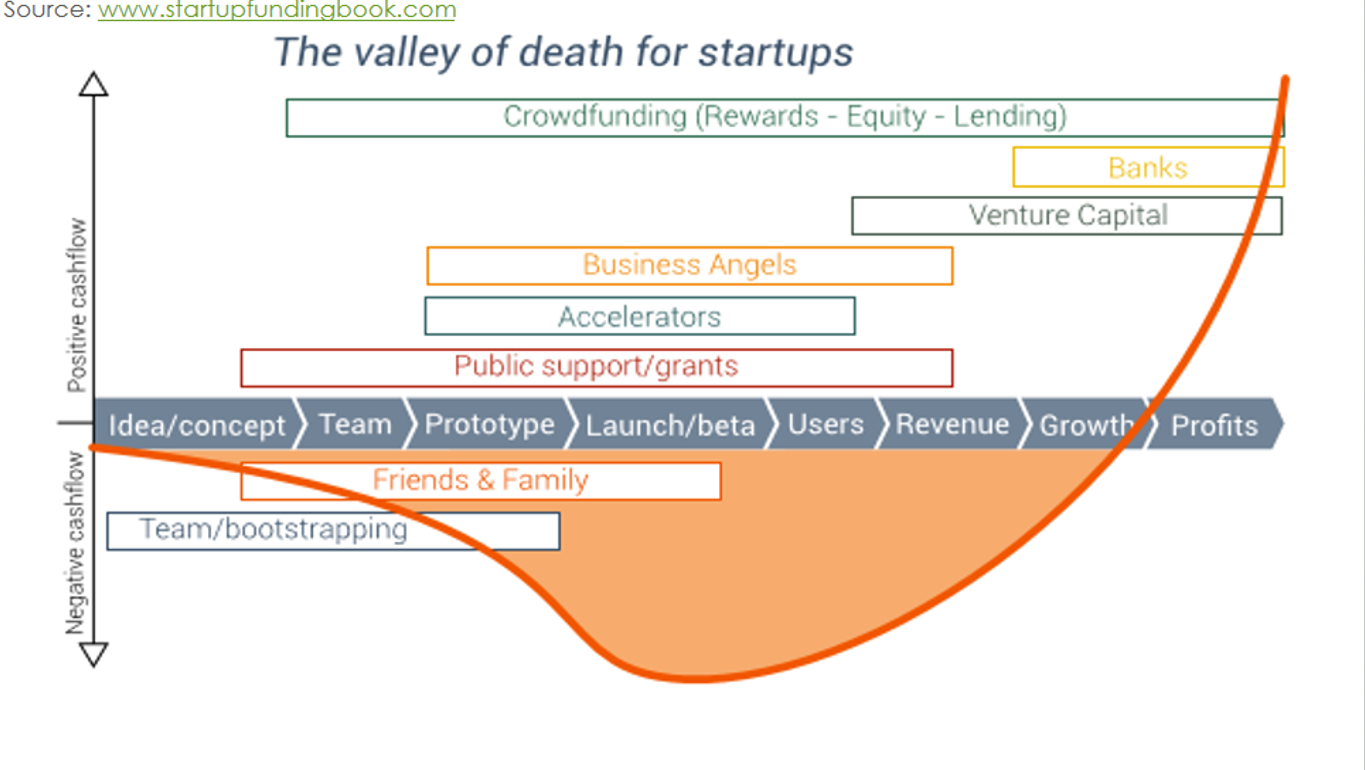

Innovation Valley of Death

The death valley curve is an expression used by early stage funders to describe the critical initial phase of a startup company. During this period, startup companies must operate without any existing revenue, relying on their initial invested capital. … This is a significant milestone for startup companies and many new businesses fail in this space.

3F’s, Angel Groups, and VC Funding for Innovation

The 3F’s (family friends and fools) often provide the seed money for new businesses. Angel investments have developed as a strategic funding group, and venture capitalists had got a bad reputation early on for taking over the company. It is important to have goals, business plans etc.

Exits No Longer Mandatory

Once VC funds only stayed in for 8 to 10 years and then exited with an IPO. Now many are not listing but staying as private companies and get a better return without the overhead of public listing. Other private funding groups invest in these capital funds.