Nickel in batteries is a component in batteries for decades. A battery has a cathode and an anode. The cathode and the anode (graphite) forms most of the battery. Nickel is a chemical element and a transition metal. Most nickel use is as a component of high-grade steel manufacturing. Nickel increases energy density in batteries. Most industry experts forecast nickel-based lithium ion batteries will continue for decades.

In batteries, the commonly known product is lithium but the reality is graphite is a higher percentage. Batteries are a mix of Lithium, cobalt and nickel and manganese. Prior to the use of lithium-ion in battery technology, nickel was the anode with a Fe cathode. Current lithium ion batteries have a graphite anode, and nickel cathode.

The cathode of modern lithium ion batteries comprises graphite and nickel.

Global production of nickel from mines is about 2.5 million metric tons in 2020. The major countries in nickel mining include Indonesia, the Philippines, Russia, and New Caledonia. Indonesia is also the country with the largest reserves of nickel, followed by Australia and Brazil.

Nickel Production Data

Nickel reserves are among the metals and minerals with the least remaining life years, however, because nickel is a highly recyclable material, this poses less of a problem.

Leading nickel companies worldwide in 2020 based on production volume (‘000 T) from Statista

Stainless steel uses nickel steel made from nickel sulphide and laterite ore whereas batteries use nickel sulphate.

Nickel Demand Growth

The miners (such as IGO) use data from Bloomberg NEF to show the growth and expect nickel demand to increase by over 7 times. Nickel and lithium expected to be strong beneficiaries of increased battery demand.

Nickel Demand by IEA To 2040

Updated Nickel Demand

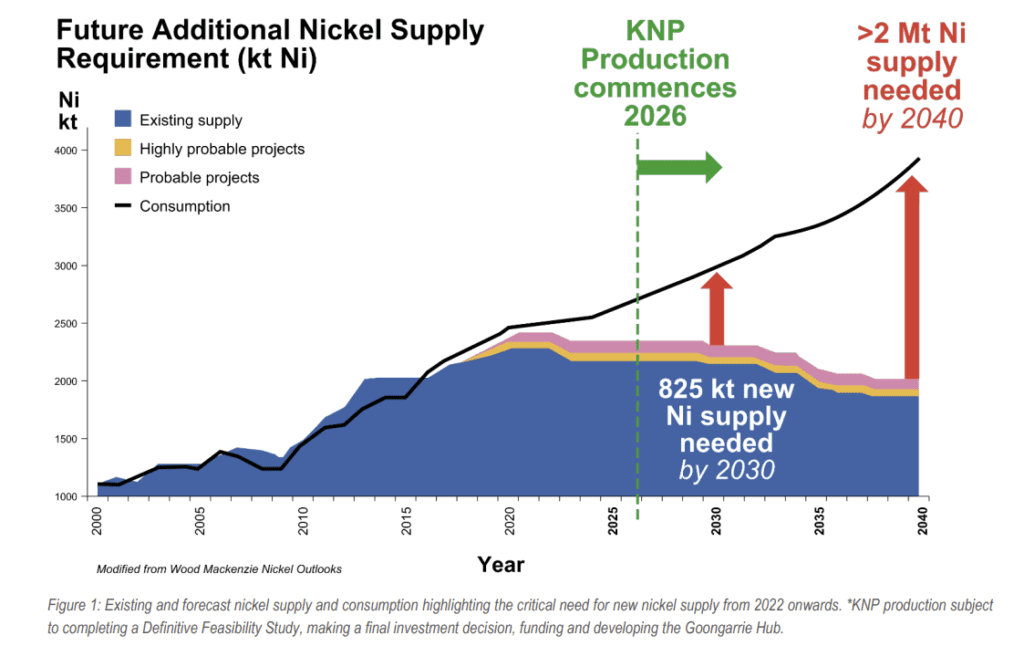

Ardea Resources in their 2023 presentation have this graph for nickel and cobalt – as their mine is typical with both nickel and cobalt in the formation.

Traditionally, specialist steel allows is the primary use of nickel. Nickel is the 5th most common element with 72% used in stainless steel, and ~ 7% in batteries. See Nickel Institute.

- Indonesia – 21 million tonnes

- Australia – 20 million tonnes

- Brazil – 16 million tonnes

- Russia – 6.9 million tonnes

- Cuba – 5.5 million tonnes

- Philippines – 4.8 million tonnes

Nickel Opportunity

The shortage of nickel, and the Ukraine war has reduced supply from Russia. Globally, nickel supply does not meet existing demand, and many of the major miners are seeing their reserves come to the end of their lives.

Nickel Demand Forecast to Double over next 2 Decades

Nickel Use increases 7% to 41% use over 2 decades

Nickel Production Risks