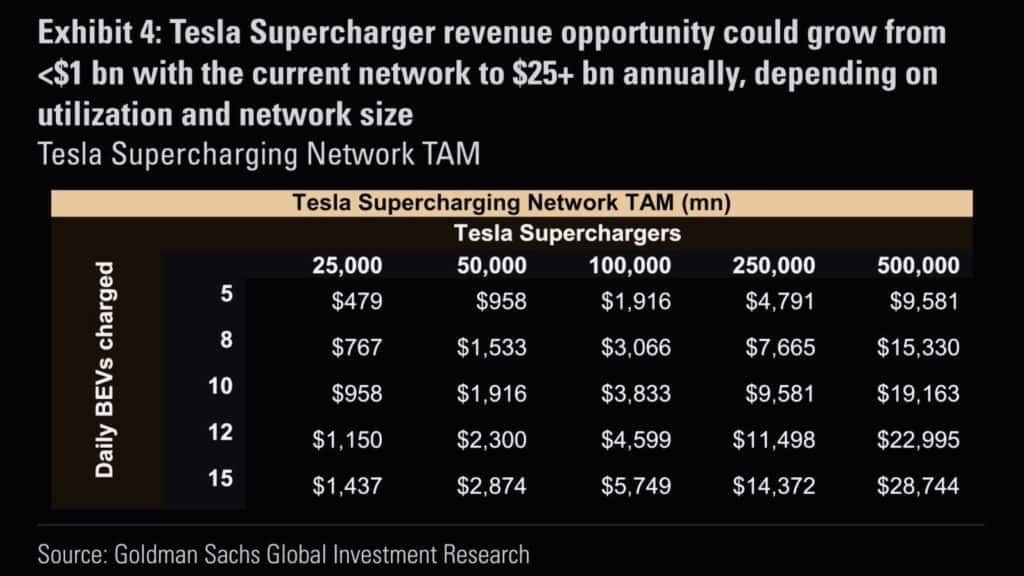

Goldman Sachs estimates the Tesla Supercharger Network could make more than $25 billion in annual revenue by opening up its charging network to other electric cars. The charging network is the new oil company service/gas station and there are already a larger number of chargers. This charging network is one of the “moats” that Randy Kirk identifies in his book “Elon Musk – the Mission“

Tesla Supercharger Network Revenue > $29 billion

Growing Calls for Simpler, Unified Reliable Fast Charging

Back in mid 2022, Goldman Sachs analyst Mark Delaney has made a case for opening Tesla’s (NASDAQ: TSLA) Supercharger network to all EV drivers. The network is the largest in the US and one of the largest globally with about 35,000 connectors. Delaney estimates that “utilization across the Supercharger network in the US by Tesla drivers is in the mid to high single digits range on average during the day.”

Tesla Supercharger Network Opens Up

In February 2023, Tesla and President Biden agreed to open up the Tesla Supercharging network to all.

- About 10% of the superchargers will be available.

- Biden administration wants at least 500,000 electric-vehicle chargers across the U.S. by 2030.

- IRA bill has $7.5 billion allocated.

- Tesla will make at least 7,500 of its superchargers open to any EV by the end of 2024.

- At least 3,500 new and existing 250 kW Superchargers along highway corridors

- Level 2 Destination Charging at locations like hotels and restaurants in urban and rural locations.

- Adapters may be required.

- Tesla plans to triple its network over the next few years

The USA IRA bill is Driving Charging

Daily news shows the race is on to build an electric charging network equivalent to the gas station chains.

- Must use CCS (Combined Charging System) adapter. CCS is the standard in Europe.

- Must be >97% uptime. Tesla currently has 99.97% uptime or 4 hours downtime per year.

- There are > 3 million EVs on the road in USA or 6% of all vehicles

- Over 130,000 public chargers across USA

- By July 2024, at least 55% of the cost of all components will need to be manufactured in the USA

- At least 11 companies are establishing new U.S. facilities to meet IRA onshore manufacturing requirments.

- BP has said it aims to invest $1 billion in EV charging in the U.S. by 2030.

- Hertz’s objective is to make one-quarter of its fleet electric by the end of 2024.

- GM plans to have 40,000 by end of 2026

- Truck stop company Pilot, General Motors & EVgo EVGO are building a coast to-coast network of 2,000 x 350 kW fast chargers at Pilot and Flying J travel centers along American highways.