The media publishes many articles on green hydrogen opportunities. Many misconceptions are detailed in Hydrogen Myths. We summarise green hydrogen opportunities which may help improve exports, reduce mining emissions and decarbonise the existing fossil methane-derived grey hydrogen economy.

Not all Opportunities are real

Green hydrogen might play a role in decarbonisation. Here are just some of the challenges and opportunities

- Where is the supply?

- How do you get sufficient renewable energy

- Can you mass-produce the electrolyzer to bring the cost down

- Are there new electrolyzer technologies that can reduce costs under $1 per kg.

- Market opportunities.

USA Infrastructure Bill Impact on Green Hydrogen Opportunities

Plug Power CEO Andy Marsh is reported to say the newly announced Clean Hydrogen Production Tax Credit (PTC) of $3/kg for green hydrogen will enable it to match and beat grey hydrogen in just about every application and will be as significant to the hydrogen industry as the tax credits that underpinned the wind and solar industries. (Reneweconomy Aug 2022). PlugPower expects grey H2 applications can switch to green H2.

- Fertiliser manufacturing

- Steel

- Gas heating

- Cement manufacturing

Recent H2 Media

FFI

FFI (Fortescue Metals ASX:FMG) has already developed their own hydrolyser to create green hydrogen (CleanTechnica) in their article Green Hydrogen Dominoes Stacking Up. FFI Chief Executive Officer Julie Shuttleworth “FFI has developed a number of new electrolyser technologies that will form part of their electrolyser patent family. The outcomes of these projects will inform FFI’s electrolyser technology selection going forward, as FFI works towards its target to produce 15 million tonnes of green hydrogen per year by 2030”. The electrolyser will be producing green hydrogen by the end of 2022 powered by solar panels installed on the roof of FFI’s Dawson Road facility near the Perth Airport, Western Australia.

Plug Power

Plug Power Inc. (NASDAQ: PLUG), a leading provider of turnkey hydrogen solutions for the global green hydrogen economy, and Fortescue Future Industries Pty Ltd (FFI) 50/50 joint venture to build a Gigafactory in Queensland, Australia. FFI agreed to purchase 250 megawatts of Plug Power’s electrolyzer solutions. Plug Power will supply these from its Gigafactory in Rochester, N.Y., . Delivery is planned for the second half of 2022

Queensland Govt

The Queensland government has announced a feasibility study will be conducted into the use of hydrogen-powered trains for bulk freight. Freight operator Aurizon and mining group Anglo American will conduct the study, looking at whether hydrogen fuel cell and battery hybrid power units can be used in heavy-haul freight rail operations. (Press release)

QLD Govt fast-tracked a construction site at Gladstone QLD. FFI and Plug Power intend to build a two-gigawatt factory to produce large-scale proton exchange membrane (PEM) electrolysers, with the ability to expand into fuel cell systems and other hydrogen-related refuelling and storage infrastructure in the future. (Press release)

QLD Govt fast-tracked a construction site at Gladstone QLD. FFI and Plug Power intend to build a two-gigawatt factory to produce large-scale proton exchange membrane (PEM) electrolysers, with the ability to expand into fuel cell systems and other hydrogen-related refuelling and storage infrastructure in the future. (Press release)

Western Australia

Australian solar park could generate hydrogen for less than $2/kg says PV-Magazine. The Bristol Springs – south of Perth Australia is planning to have an alkaline electrolyser and produce (PV Magazine Australia) Frontier said the projected unit cost of $2.83 per kg is lower than AEMO cost of $6. To be built in 2023, on a 195-hectare site next to the Worsley alumina refinery, the project is able to access existing infrastructure, including the Landwehr Terminal power line, allowing for excess solar energy to be sold via WA’s main energy grid. The company said there are also several established water sources in the area, meaning there is no requirement for capital-intensive infrastructure like desalination.

International Media

- JBC – a manufacturer of industrial construction equipment have agreed that green hydrogen will be used to power construction equipment (press release) and Fortescue to be a supplier

- JBL signed a deal to convert UK bus fleet to hydrogen using that hydrogen (Press Release)

- The agreement has JCB and Ryze purchasing 10 percent of Fortescue’s global green H2 output. The UK companies will be managing the distribution of the renewable energy fuel alongside the UK’s “development of customer demand, (Press Release)

Green Hydrogen Organisation (GH2)

FFI funded the GH2 as a consortium of like-minded investors, and a recent conference in Barcelona has some ambitious goals. (From Recharge). Key points include:

- The ambitious global campaign, aimed at COP27 is to produce 100 million tonnes of green H2 annually by 2030, up from less than 100,000 today.

- Repace 1 million tonnes of grey hydrogen with green H2.

- No blending of up to 20% H2 into Gas.

- Fortescue targets 15 million tonnes of green hydrogen produced annually by 2030

- Green energy needed is 1,400 GW or 5,000 TWh. To put this in perspective, in 2021, the word added 290GW RE

- Would need to double new RE installed each year.

- Green hydrogen would actually be cheaper to produce than grey H2 in most parts of the world today due to high natural-gas prices, and due to the dash from Russian gas, those prices are not likely to fall any time soon.

Green Hydrogen Opportunities

Green hydrogen has 3 problems to solve: cheap manufacture; cheap storage and transport; and customer uses

- Replacement of existing gray Hydrogen use

- Construction or mining heavy vehicles

- Shipping – replacement for bunker oil

- Green steel making

- Heating

- Backup for electricity production

1. Replacement of existing Hydrogen

Green hydrogen can rapidly replace the existing use of gray H2 (The Economist’s).

- Technology change not needed. The only change is to pay a fair price.

- The methane to H2 facilities will become stranded assets.

- No compression/storage or transport infrastructure.

Today’s hydrogen business is, in global terms, reasonably small, very dirty and completely vital. Some 90m tonnes of the stuff are produced each year, providing revenues of over $150bn—approaching those of ExxonMobil, an oil and gas company. This is done almost entirely by burning fossil fuels with air and steam—a process which uses up 6% of the world’s natural gas and 2% of its coal and emits more than 800m tonnes of carbon dioxide, putting the industry’s emissions on the same level as those of Germany.

The Economist Oct 2021

2. Heavy Vehicles

JCB (UK) have new supply contracts. Mining companies use over 4 billion litres of diesel in Australia and Fortescue iron uses 3 billion litres of that. Conversion of those trucks with H2 fueled trucks would provide immediate end-use.

3. Shipping

Some are looking for swapping out dirty bunker oil (see cruise ships toxic legacy). Removal of fossil fuel (coal, oil and gas) will remove 50% of shipping traffic. Others are looking at using H2 for fuel. As reported by Renew Economy in June 2022 running cargo ships entirely on green hydrogen-based fuels would add less than 15 cents to a new pair of Nikes or up to $12 for a new fridge. Transport & Environment (T&E), Europe’s leading clean transport campaign group, analysed the likely cost increase in seaborne transport if the sector were to fully decarbonise.

4. Green Steel Making

See the previous article on steel making. It may be that Fortescue Frehas its eye on establishing a steel production factory in Western Australia. Why?

- Iron ore processed in Australia has more value as green steel rather than raw ion ore.

- Reduced shipping costs

- The steel making process may be cheaper than burning metallurgic coal when using low cost renewable energy and green hydrogen.

- Green steel demand will rise.

5. Heating – substitution of Methane Gas (LPG and natural gas) by H2

Hydrogen can substitute for fossil methane gas but this will depend on the reticulation of gas. This is a major issue (See H2 Transport and Distribution Challenges)

6. Backup Electricity Grids

The economics of battery, grid interconnection and mix of energy sources would make costs may exceed benefits. Gas peakers could use a gas / H2 mix. The quantities of green H2 proposed by Dr Andrew Forrest will be disruptive.

- Diesel generators provide backup power at data centers in the event of power outages. Plug Power, working in partnership with Microsoft, built an alternative 3 MW fuel cell backup system. The fuel cell systems developer designed and manufactured the 125 kW proton exchange membrane (PEM) fuel cells in Latham, New York. The company packed 36 fuel cells into a pair of 12-meter-long shipping containers, each holding 18.

- A Spanish-Indian venture will develop up to 300 MW of installed green hydrogen production capacity in the Iberian Peninsula

- I Tonne of hydrogen contains 33MWh of electricity. A kT = 33GWh

- Fortescue Futures Innovation Australian projects = 150m tonnes annually of H2 for export market by 2030.

- A similar project is planned for the Pampas in Argentina, one of the windiest places on Earth with 200m tonnes of H2 = 33GWh x 200 = 6.6TWh of GREEN electricity.

Hydrogen Technology Improvements

One problem H2 faces is the cost of the technology to make green hydrogen.

- Gray or blue hydrogen using carbon capture and storage is not green

- R&D may enable cheaper production.

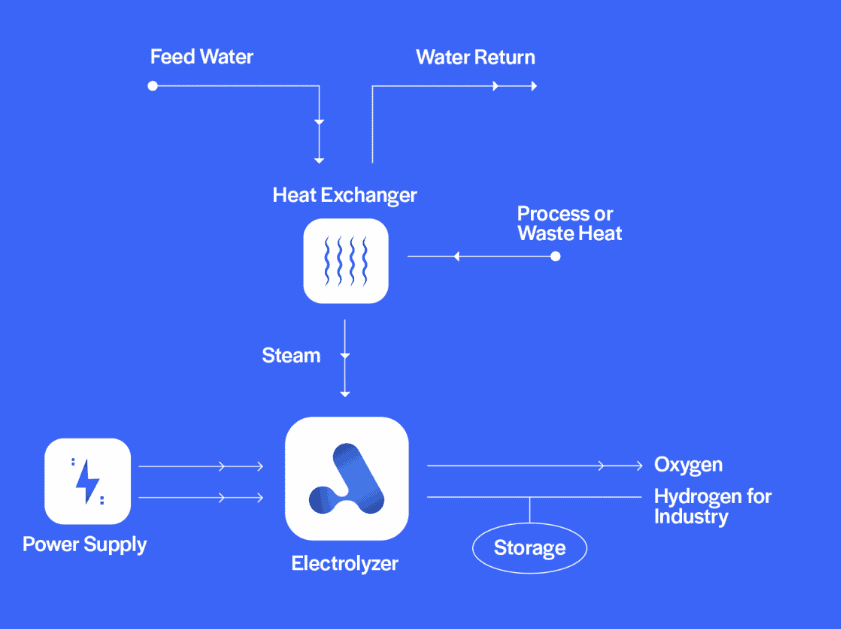

Alkaline, anion exchange membrane (AEM), and polymer electrolyte membrane (PEM) are cold electrolyzers using liquid water. Solid oxide electrolyzers are hot electrolyzers working with heated steam, corresponding to higher efficiency. High efficiency and cheaper materials with a midrange temperature electrolyzer is an optimal goal. The industry is currently trying to step away from platinum which Russia is a major supplier. The technology uses engineered porous metal electrodes and composite ionic materials for its electrolyte.

Advanced Ionics

Advanced Ionics has developed an electrolyzer that runs at temperatures below 650 C. It is reportedly able to produce hydrogen for $0.85/kg or less. An interview with the CEO is on PV Magazine in May 2022. The CEO says “Our Symbiotic technology is a new class of electrolyzer. It is not alkaline, PEM, or Solide Oxide (SOEC)”.

Other electrolyzers require a minimum of 40 kWh per kilogram of hydrogen and are usually closer to 50 kWh. Advanced Ionics claim they can produce hydrogen for below 35 kWh, and that results in a dramatically lower cost,