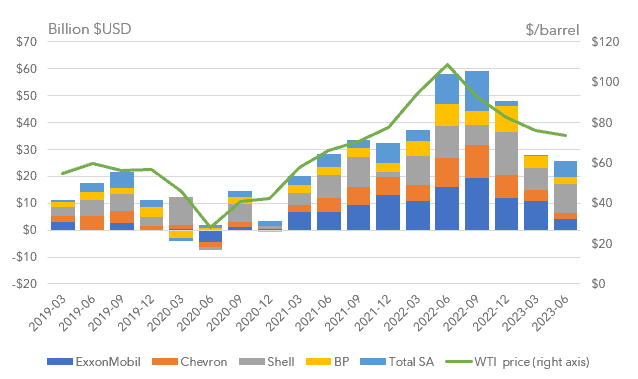

Top five oil and gas companies including Shell, BP, Exxon, TotalEnergies, and Chevron showed in full year 2022 fossil fuel excess profits of $134b over the average longer-term profits of about $50b per year. I.e. The total profits from these companies were nearly $200 billion. In total the five returned $102b in profits to investors with $48b in dividends and $54b share buyback.

Profits From Misery

These profits come from a brutal year in 2022 . Putin’s invasion of Ukraine killed more than seven thousand civilians and displaced at least 14 million Ukrainians. The war brought turmoil to already strained global energy and food markets, forcing up to 95 million people into extreme poverty.

Meanwhile, greenhouse gas emissions continued to rise and extreme heat waves, droughts and floods destroyed livelihoods across the globe. Historic floods in Pakistan alone killed more than 1,730 people and affected at least 33 million lives.

Climate Change Will Exceed 2 degrees in next 3 decades

Most worrying is that recent AI analysis of climate data shows that the 1.5℃ threshold will be exceeded by 2030, and in all assessments, a 2℃ rise is also certain within 3 decades. Yet carbon emissions continue to rise and this energy crisis makes that more probable.

Global Energy Crisis

At the heart of the industry’s profit lies the world’s first truly global energy crisis. Wholesale gas prices were already high, but then prices skyrocketed. US President Biden accused the industry of “war profiteering” while UN secretary general Guterres warned that the companies “have humanity by the throat”.

This level of political influence comes after the global oil and gas industry secured (Guardian) $52 trillion dollars in profits since 1970, a recent analysis of World Bank data revealed. That is $2.8 billion per day. And, in the words of the study’s lead author, enough “to buy every politician, every system.”

“All developed countries to tax the windfall profits of fossil fuel companies”

Antonio Guterres, UN Secretary General (Sept 2022)

“Look at what they’ve done in the last 40 years, look at the evidence. They’ve shown the world that they will put profit above us and above the planet, and so we would be fools to trust them.”

Peter Kalmus Climate Scientist, NASA’s Jet Propulsion Lab

Financial and Carbon Emissions

If the companies were charged a carbon tax, the last column shows their excess profit would become a loss. That difference is part of the trillions of fossil fuel subsidies of $11m per minute.

| Company | Revenue | Total Profit ($b) | Excess Profit | Scope 2 Emissions | Total Scope 1,2,3 | Profit / Loss with CO2 Tax |

|---|---|---|---|---|---|---|

| Shell | 381 | 40 | 23 | 60 | 1,377 | (138) |

| BP | 248 | 28 | 21 | 374 | 1,600 | (160) |

| Chevron | 246 | 37 | 20 | 63 | 697 | (70) |

| Exxon | 413 | 56 | 43 | 112 | 784 | (78) |

| TotalEnergies | 263 | 21 | 11 | 37 | 410 | (41) |

| Total 5 companies | 1,551 | 180 | 118 | 646 | 4,868 | (487) |

| Aramco | 552 | 42 | 79 | 553 | (55) | |

| Sinopec | 480 | 9 | 176 | 1,232 | (123) |

Notes

- Used a European Carbon Price €100 (about $US105)

- Generally about 90% emissions are scope 3, and only 10% scope 1 and scope 2

- TotalEnergies reported 455 mt CO2 emissions in 2019 – roughly as much as Mexico emits in a year. Their plan is to reduce by less than 5% over the next decade

- Exxon claims only 650Mt of scope 3 emissions

Fossil Fuel Excess Profits are Losses with a Carbon Price

The Carbon price in Europe has risen to about €100 per tonne in late Feb 2023. If these companies had paid an emissions tax for all of their Scope 1 2 and 3 emissions then that money would have made a substantial investment in the change in investment in renewable energy. Not only that but these oil and gas companies have plans to spend billions of dollars on further expansion of their fossil fuel businesses.

BP said “ in the interests of energy security, they are now going to scale back their 2030 emissions reduction target. They were going to go for 40% cut to 25%”

Others, such as Exxon have plans that will not abate emissions at all. Their new investment will increase emissions.

Greenwashing

Between 2010 and 2018, Chevron is analysed to have dedicated only 0.2% of its long-term investments to sources of low-carbon energy like wind and solar. Estimates are over $5.3 billion of Chevron’s 2019 capital expenditure on ‘upstream’ fossil fuel extraction and production, and 66% of the company’s future capital expenditure is on fossil fuels with no 1.5 nor net-zero targets.

Followup

A year after these super profits, IEEAF in an article suggested the tide had turned on super profits. Key points:

- All oil and gas supermajors reported falling revenues and slimmer profits for the second quarter of 2023, stemming from a decline in global oil and gas prices.

- Compared to the second quarter of 2022, the price of oil fell by a third and the supermajors’ collective free cash flows—the cash generated by their operations, minus capital expenditures—fell by 56%

- Supermajors reverted to deficit spending, and also raised money by selling off “non-core assets,” framing this risky practice as a reasonable business strategy.

- High prices related to Russia’s invasion of Ukraine have now fallen, and banking on more geopolitical turmoil to inflate revenues and profits is the opposite of a sustainable, low-risk business model.

How long will oil companies continue to operation as business as usual?

References

The benchmark EU Allowance (EUA) December 2023 contract closed at €98.30 per tonne in Feb 2023 (Reuters)

‘Shocking’: Greenpeace accuses TotalEnergies of hugely underreporting carbon emissions https://www.euronews.com/green/2022/11/03/shocking-greenpeace-accuses-totalenergies-of-hugely-underreporting-carbon-emissions

Exxon made a record €51 billion profit. Only 5% is going to ‘low-carbon’ projects https://www.euronews.com/green/2023/02/01/exxon-makes-record-51-billion-profit-only-5-is-going-to-low-carbon-projects

Greenhouse 100 Polluters Index (2022 Report, Based on 2020 Data) https://peri.umass.edu/greenhouse-100-polluters-index-current

Data-driven predictions of the time remaining until critical global warming thresholds are reached. 2023 Noah S. Diffenbaugh, Elizabeth A. Barnes https://www.pnas.org/doi/full/10.1073/pnas.2207183120

Exxon Greenwashing its Carbon Emissions Exxon has 25% of all LNG production. https://www.clientearth.org/projects/the-greenwashing-files/exxonmobil/

TotalEnergies Greenwashing Major Failure: TotalEnergies’ climate plan fails to reduce emissions. https://reclaimfinance.org/site/en/2022/03/24/major-failure-totalenergies-climate-plan-fails-to-reduce-emissions/

Greenwashing Files: Aramco https://www.clientearth.org/projects/the-greenwashing-files/aramco/ Aramco operates over 100 oil and gas fields. These include the world’s second largest onshore oil field, the Ghawar field, the world’s largest offshore oil field – the Safaniya field – and Jafurah, the largest shale gas field outside the US. Aramco’s proved oil and gas reserves dwarfed the combined reserves of Exxon, Chevron, Shell, BP and Total. At the 2020 production rate, Aramco’s proved reserves could be burned until 2077.