The race to electrify the transport and energy sectors has given rise to the 282 battery gigafactories in production or announced by 2031, with nearly 6GW of lithium ion capacity. (Benchmark Intelligence Mar 2022). Where are they? Why so many? The market for lithium-ion EV batteries is now a $27 billion per year business, and expected to increase by at least 10 times by 2030 as all existing ICE vehicle production becomes EV production.

The demand is enormous. An average electric vehicle will need about 70kW of battery to provide a 300 to 400km range. So if a manufacturer makes 1m vehicles a year they will need at least a 75 GW capacity factory.

The trend is for batteries to come down in cost. Costs have reduced 97% over 2 decades to R&D, and scale in production and advent of Gigafactories. Lithium-ion batteries will be primary battery for at least the next decade:

- Lower cost to make primarily due to ongoing R&D but also due to gigafactories such as Tesla / Panasonic Nevada Gigafactory.

- Becoming better. Lithium-ion batteries are now probably three times better than they were in 2015. More energy dense, longer life.

- Becoming abundant due to these gigafactories scale.

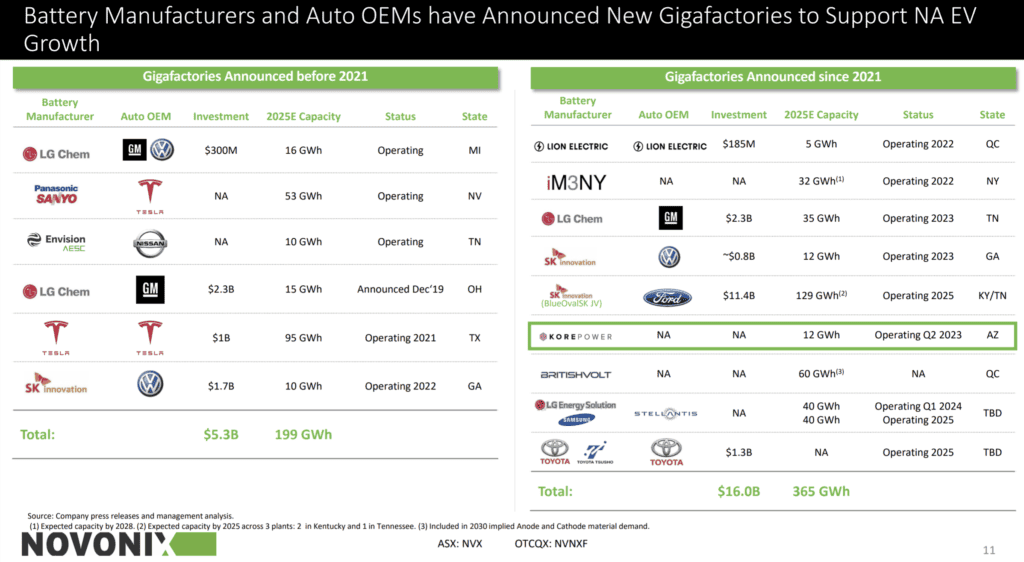

Battery Gigafactories in USA

The USA has about 20 million of the 80 million vehicles sold annually. The Gigafactory name came from Tesla and partner Panasonic from their Nevada Gigafactory naming and is now used by Tesla for Shanghai, Berline and Texas Gigafactories for cars. But associated with the car manufacturing, they have to be matched with battery factories.

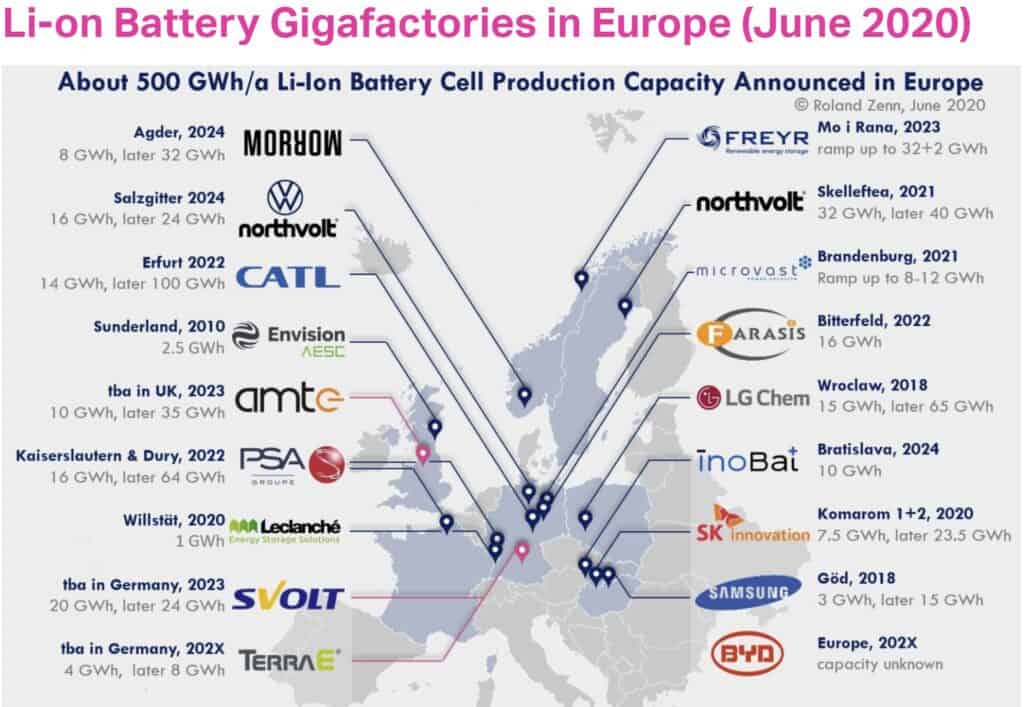

Gigafactories for Europe

Over 500 GWh annual production capacity for Li-Ion Battery cells had been announced for Europe in 2020, enough to equip approximately 7 million Electric Vehicles, and those announcements have further increased in 2021. Europe has about 20 million of the 80 million cars made globally.

The most recent announcements are for a total of 38 (CleanTechnica June 2021). 17 secured funding; representing approximately $30 billion of total investment. Ten other projects, $16.8 billion are partially financed, and 11 announced.

If all 38 gigafactories make it to production, they could be delivering as much as 462 GWh worth of battery cells by 2025, and 1,144 GWh by 2030, enough to power over 90% of expected new vehicle sales in that year. According to Transport & Environment’s analysis, this would give Europe a 20% market share of global cell production by 2025, making it second only to China.

Cleantechica Jul 2021 : https://cleantechnica.com/2021/07/03/europe-planning-38-new-ev-battery-gigafactories/

Even in UK, a Chinese based manufacturer, Envision, announced in Oct 2021, annual capacity at a Nissan Leaf supplier, would eventually rise to 38 gigawatt hours (GWh), an increase from a previous plan of 11GWh (July 2021).

Resources Needed for Gigafactories

- Lots of energy

- Lithium for cathode

- A range of other minerals such as cobalt, nickel rare earth elements, steel and aluminum

- Graphite for the anode

- Manufacturing plant

Global Demand

The relative quantities are in this graph.

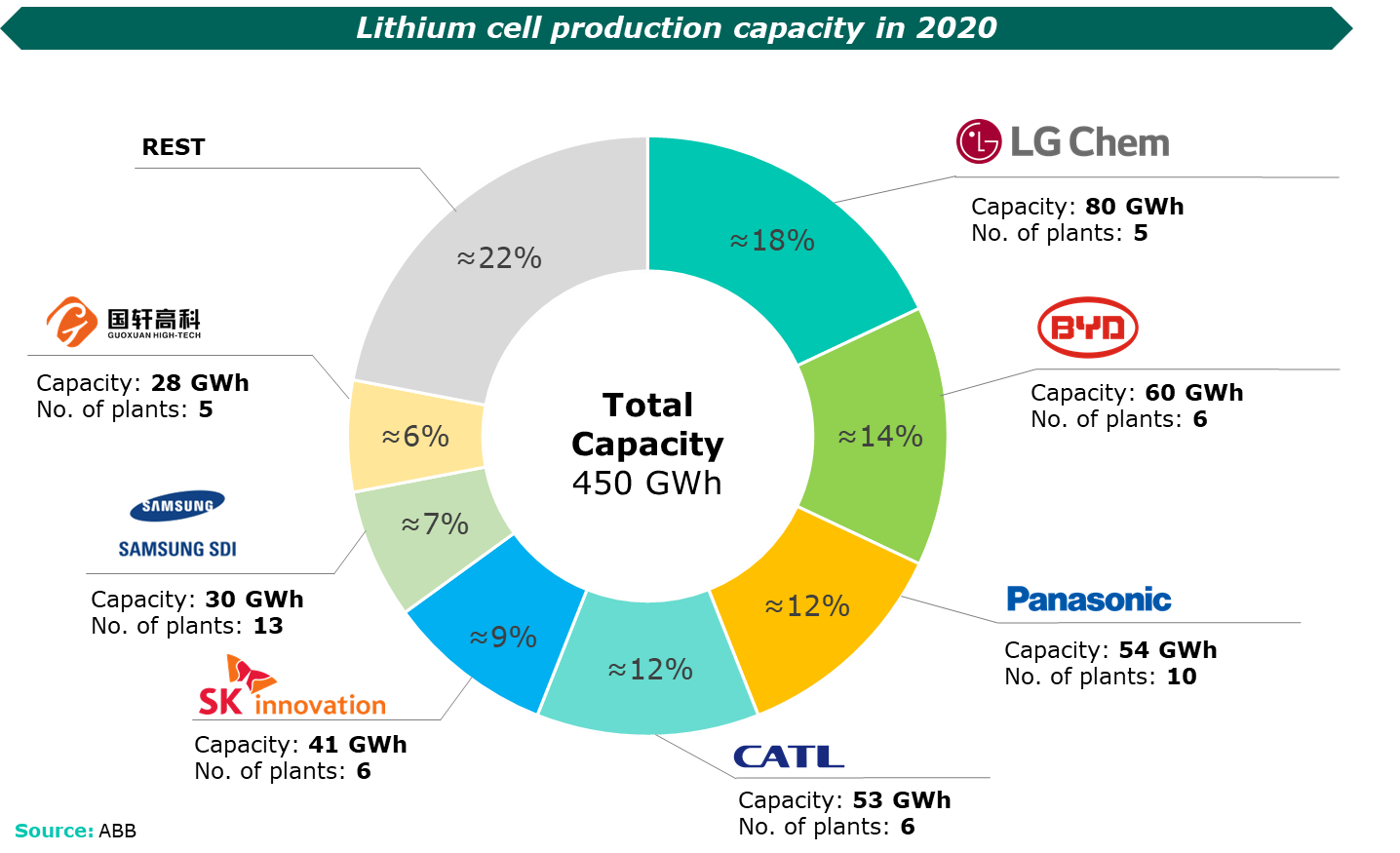

Global Battery Cell Manufacturers

A Disconnect: How GigaFactories Need to Focus on Supply

From Morning Brew Interview with Simon Moores, CEO of Benchmark Mineral Intelligence

A good way to understand it is that it takes at least five to seven years to build a lithium mine. With all the money in the world, you can build one in five years. But it takes 24 months to build a gigafactory, so that’s the disconnect. And still the automakers are announcing all these battery plants. At the same time, they should be announcing new lithium mines—or new lithium-refining capacity, at least, if they didn’t want to get into mining—because they go hand in hand. But that’s not happening yet. And as a result, any of the EV goals between 2026 and 2030—it’s a red alert. Most of these guys won’t even meet a fraction of their EV targets because of that.

Expected Battery Materials Demand Growth

The increase in batteries will demand huge growth. Lithium from 450,000 tonnes to 6m tonnes. Nickel. Cobalt and graphite.

Have lithium costs affected the price of lithium-ion batteries over the last few years?

Batteries have been going down in price and manufacturing costs the last 5 years, since the creation of Tesla’s Gigafactory: scale allows to make them cheaper.

Raw material costs have been low, but what’s happened in the last year is raw material costs, especially lithium, are rising significantly. Lithium is the big one here. And at the same time as these battery costs keep dropping, raw materials are a much bigger proportion of the pie—the cost pie. So lithium prices have gone up and they’re now impacting battery cells.

What does it mean when you say there’s a lithium shortage?

So the “structural shortage” is what the commodity industry calls it. That’s when there’s literally not enough capacity in the industry to meet that demand. This year was the year where supply got tight and then it has just fallen into shortage in the last few months. It’s a very clear shortage, a structural shortage. It’s kind of no going back.

With automakers announcing these ambitious EV goals, are OEMs preparing to deal with this shortage?

It’s funny, I think OEMs are quite a unique beast in this sense. The OEMs only plan to build battery plants. They don’t think about the raw materials. And that’s because they don’t come from that world. The traditional automotive supply chain is built to serve them, and they’re used to having everything available.

But the difference now with the supply chain for electric vehicles—it’s being built from scratch and doesn’t exist at the scale they need, so they don’t think about the raw materials, and we call this the great EV raw material disconnect. Two years ago, they weren’t even thinking about batteries. They are thinking about batteries now, which is good. But they’re still not thinking about raw materials. And that’s a huge risk to anyone that’s really making EVs beyond 2025 or 2026, which is nearly everyone.

Will lithium production increase in the coming years?

The next big one that’s scheduled to come on stream next year—and it’s the first big lithium chemical operation in maybe 15 years— it’s Lithium Americas in Argentina. Back in 2011, they started it. It’s now 2021, and it’s just about coming on stream.

There are over 150 junior exploration miners seeking lithium, and if they each produce 50kTpa, that is still over 40 mines that need to come on stream

Battery Gigafactories Novanix

Novanix lists the these battery gigafactories in their 6 month Quarterly reports in Jan 2022. Novanix have a relationship with KorePower who are planning a 12GW gigafactory by Q2 2023. The total in the USA is over 365 GWh.

Quarterly Activities/Appendix 4C Cash Flow ReportEV Makers & Battery Suppliers