The 5 disruptions by Cathie Wood, CEO of the investment fund Ark Invest, a USA investment fund are robotics, energy storage, AI, blockchaing and DNA sequencing. She is a strong supporter of Elon Musk and has a different perspective than Tony Seba who talks about 3 disruptions from 8 technologies one of which is disruption in the food and animal industry. Cathie Woods focuses on 5 technologies that are disrupting our 21st Century today and all of these 5 are well underway and disrupting existing businesses.

Change appears to happen slowly and then all at once. Over time, innovation should displace industry incumbents, increase

Cathie Wood – Big Ideas 2022

efficiencies, and gain majority market share.

There is a commonality between Wood and Seba but they present them in different ways. As CEO of Ark Invest, Cathie focuses on the companies involved today and in the next decade. Seba focuses on what the world will look like.

ARK Podcast: 5 Disruptions by Cathie Wood

In this interview of Cathie Wood from a summit in Jan 2022, Big Ideas 2022 she outlines the following disruptions for the future – for our world and our children. The Big Ideas can be downloaded from their website. We are potentially in a utopian world and have never been in a time when so much is changing. Back in the 1900’s they had 3 technologies that revolutionized the world: telephone, electricity, and automobiles. These 5 disruptors are enablers in the 14 technologies sectors.

Cathy in the podcast focused on some areas. Ark Invest is confident that these will scale at 30% compound annual rate of return. The five major innovation platforms are simultaneously evolving. Humans have burnt rocks for heating, cooking and energy including transportation for over a million years. What solar and batteries change is the transition from a fuel-based energy system to a technology-based energy system that is scaleable, will become cheaper and will also disrupt a range of industries.

- Robotics

- Energy storage

- AI

- Blockchain

- DNA Sequencing

14 Underlying Technologies

The 14 underlying technologies that contribute to the 5 disruptions provide the basis of the various ARK Invest funds, and they identify companies in each of these technologies.

- Artificial Intelligence

- Digital Consumer

- Digital Wallets

- Public Blockchains

- Bitcoin

- Ethereum and DeFi (decentralized finance)

- Web3

- Gene Editing

- Multi-Omics

- Electric Vehicles

- Autonomous Ride-Hail

- Autonomous Logistics

- Printing and Robotics

- Orbital Aerospace

Key Features of these Technologies

1. Artificial Intelligence (AI)

Enabling Humans To Become Superhuman is how they describe AI. By automating the tasks of knowledge workers, AI should boost productivity and lower unit labour costs significantly. Many people are worried about the misuse of AI particularly in war and China wants to win at this game. Will that decrease human freedom or increase it? Many are developing new semiconductors to advance AI – including Google, NVidia, Tesla and Chinese companies. AI will contribute to innovation to solve problems and makes the world a better place. ARK sees AI converging with multiple other technologies – with AV, gene editing and Genomic Sequencing. AI training costs are decreasing at 2x that of Moores Law. Many believe AI will make jobs such as software development, accounting, lawyer and admin 1 to 4 times more effective within 10 years.

2. Digital Consumers

The COVID-19 crisis accelerated the shift from offline to online activities. Ark estimate that on average in 2021, internet users spent

38% of their free time online and 62% offline. By 2030, we expect these averages to flip, with users spending 52% of their free time

online and 48% offline. Shopping. Social platforms. Digital advertising. Social Commerce. Games,

3. Digital Wallets

Digital wallets have upended traditional banking and continue to increase.

4. Public Blockchain

Public blockchains minimise the need to trust centralized authorities. The blockchain is already in asset management (diamonds, trade) and hedge funds. Bitcoin, a cryptocurrency, is built on a public blockchain. Blockchain is the basis of 3 revolutions

- Money revolution – Bitcoin

- Financial revolution – DeFi

- The internet revolution – or Web 3.0 development

Public blockchains are not governed by anyone. Regulators are trying to control this change. Putting guard rails is ok, but there is opposition by existing technologies that will be replaced by these new systems.

5. Bitcoin

The cryptocurrency Bitcoin is the most well known and the most profound application of public blockchains, and the foundation of “self-sovereign” digital money. Bitcoin operates as a single, decentralized institution. Instead of relying on accountants, regulators, and governments, Bitcoin relies on a global network of peers to enforce rules.

- Money – first global private decentralised money system. Just ask El Salavdore / Turkey which takes them out of the old monetary systems such as dollar or Euro and does not involve politicians. The Chinese one involves the government.

- Financial services – will usurpt financial services who are all middlemen. It will decentralise finance.

- Next Generation internet enables NFTs – private rules based property rights system. Secure, verifyable and protected.

Bitcoin mining has evolved into a multibillion industry. As the whole ecosystem becomes energy intensity and bitcoin mining becomes cheaper with zero carbon emissions. Bitcoin mining becomes part of the energy ecosystem and will drive solar adoption. Ironically in contrast to the normal anti bitcoin mining.

6. Etherium and DeFi (Decentralized Finance)

Decentralized Finance (DeFi) promises more interoperability, transparency, and financial services while minimizing intermediary fees and counterparty risk. Smart Contracts, decentralized autonomous organizations, stablecoins are all part of the technology.

7. Web3

Web3 moves from siloed data and assets to public data and assets. With consumers spending more time and resources online, the importance of digital assets is likely to increase considerably as consumer spending shifts to virtual worlds. A global framework like non-fungible tokens (NFTs) provides a stable way of taking the ownership and control of digital assets away from corporations, to the benefit of individuals. Terms such as non-fungible tokens will blur lines between consumption and investment.

8. Gene Editing

Genomic sequencing, CRISPR gene editing and AI has already provided a functional cure for sickle cell anemia (reduces oxygen to all parts of the body), beta-thalassemia (A blood disorder that reduces the production of hemoglobin) and ATTR amyloidosis (buildup of amyloid proteins). ATTR was done in the body. We will see a whole range of new treatments over the next decades.

9. Multi-Omics or Molecular Biology

Multiomics, multi-omics, integrative omics, “panomics” or ‘pan-omics’ is a biological analysis approach in which the data sets are multiple “omes”, such as the genome, proteome, transcriptome, epigenome, metabolome, and microbiome. So in Ark Invest view this transcends both health and food. So DNA to RNA to proteins are all part of these technologies.

10. Electric Vehicles

While ARK was an early investor in Tesla, they forecast, based on Wright’s Law, EV sales will increase roughly eightfold, or a 53% annual rate, from 4.8 million in 2021 to 40 million units in 2026.

Ark agrees with Seba that the effort of Tesla and a number of Chinese manufacturers has brought the operating cost of electric vehicles to lower than ICE (internal Combustion Engine) cars. Moreover, the costs continue to fall so the sticker price of an EV will lower than ICE cars within 2 years.

11. Autonomous Ride Hail

Like Seba, they see automous vehicles to reduce transport to 1/8th of current costs. They also see a rise in air taxis. Ark say autonomous Ride-Hail could have more economic impact than any innovation in history.

12. Autonomous Logistics

Covid has show how fragile global logistics are, and logistics vehicles that roll or fly will cut costs across the supply chain reducing costs by up to 22 times. One aspect is that rail will no longer be the cheapest transport, and robotic grocery delivery would lower costs by 6x. Further, drone delivery becomes cost effective.

13. 3D Printing & Robotics

3D printing and adaptable robots shorten supply chain footprints, allow for digital inventory, and reduce materials waste while cutting costs and time-to-production Ark says. Even in highly automated manufacturing such as vehicle manufacturers, there are 10 people per robot. Tesla is focused on bringing the first person robot – and targeting the robot and AI for their factories. Amazon deployed its first 200,000 robots in 7 years, and then the next 150,000 in just 2 years. 3D is still in its infancy.

14 Orbital Aerospace

Rocket re-useability has reduced launch costs by 10x or more. NASA has a big high orbit rocket – the cost per kg is $55,000. SpaceX does it for $8. The demand for hypersonic flight is expected to skyrocket.

Energy is Not one of their Future Technologies

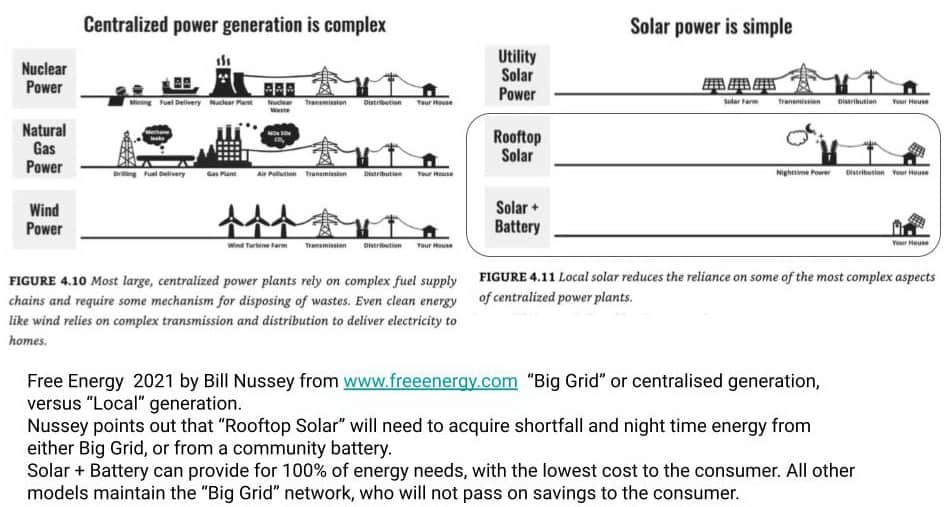

Solar and wind are not part of the technologies that Ark focuses on. Why? Because the current technology curve has already made solar the cheapest from of energy. As batteries improve, solar and batteries become part of household and business roofs. It will be financed by conventional residential financial infrastructure and is simply a feature of the house. When you buy a house now with a water heater, it is not “extra”. Currently solar is extra. This theme is taken up in Freeing Energy by Bill Nussey.

Freeing Energy – from Big Grid to Democratic Energy

Ark Invest Technologies for Disruption

Ark Invest CEO Cathie Wood talks about 14 technology disruptions as core to the 5 societal disruptions, and Ark Invest is investing in companies who provide that technology. Ark Invest has 6 EFTs (Exchange traded funds) that focus on different areas, and the companies they invest in are in their factsheets.Tony Seba of RethinkX Transport, Energy and Food Disruption has a more general view and provides only overall industry information.

Missing from ARK are 2 key technologies for Seba: solar and wind technologies, whereas Ark Invest says these already exist, and there will be improvements but they have already disrupted the industries.

| # | Ark Invest Technology | Ark Disruptions | Seba Disruption | ARK-K | ARK-Q | ARK-G | ARK-F | ARK-X | ARK-W |

|---|---|---|---|---|---|---|---|---|---|

| No. | Technology | 5 Disruptions | 3 Disruptions | Innovation | Autonomous & Robotics | Genomic | Fintech | Space | Next Gen Internet |

| 1 | Artificial Intelligence | Robotics, Energy | Transport, Energy, Labour | 5.3% | 12.1% | ||||

| 2 | Digital Consumer | Finance, Energy | Energy, Transport | 22.2% | 43.0% | 12.8% | |||

| 3 | Digital Wallets | Finance | 27.4% | ||||||

| 4 | Public Blockchains | Finance | 5.0% | 13.8% | 14.7% | ||||

| 5 | Bitcoin | Finance | 8.6% | ||||||

| 6 | Ethereum and DeFi | Finance | 28.4% | ||||||

| 7 | Web3 | Finance | 38.4% | 33.7% | |||||

| 8 | Gene Editing | Food, Health | Food | 6.7% | 50.0% | ||||

| 9 | Multi-Omics | Food, Health | Food | 16.8% | 50.0% | ||||

| 10 | Electric Vehicles | Transport | Transport | ||||||

| 11 | Autonomous Ride-Hail | Transport | Transport | 2.7% | 37.5% | ||||

| 12 | Autonomous Logistics | Transport | Labour | ||||||

| 13 | 3D Printing and Robotics | Manufacturing | Transport | 7.0% | 34.0% | 32.0% | |||

| 14 | Orbital Aerospace | Transport | 1.5% | 7.3% | 24.0% | ||||

| Energy Storage | In Electric Vehicles, Transport | Energy, transport | 15.6% | ||||||

| Wind (Seba) | Existing energy | Energy |