The IMF estimates that the total subsidy for fossil fuel in Australia is over $10.3 billion, and globally over $5.9 trillion or to put it another way fossil fuel subsidies are $11m per minute. The drive to renewable energy is happening, but while these direct and indirect subsidies are in place then renewable energy will be less competitive. The Australia Institute says that in 2020-21, Australian Federal and state governments provided a total of $10.3 billion worth of spending and tax breaks to assist fossil fuel industries. The $7.8 billion cost of the fuel tax rebate alone is more than the budget of the Australian Army. Over the longer term, $8.3 billion is committed to subsidising gas extraction, coal-fired power, coal railways, ports, carbon capture and storage, and other measures.

IMF Reports Fossil Fuel Subidies are $11m a minute

The IMF report is here. (Still Not Getting Energy Prices Right: A Global and Country Update of Fossil Fuel Subsidies)

Who Benefits from Fossil fuel subsidies

Fossil fuel subsidies are an important policy issue for all countries. Not only do energy subsidies have negative economic and environmental effects, they also mainly benefit the wealthiest households.

Measuring Fossil Fuel Subsidies

Pre-tax consumer subsidies exist when energy consumers pay prices that are below the costs incurred to supply them with this energy

Post-tax consumer subsidies exist if consumer prices for energy are below supply costs plus the efficient levels of taxation

Consequences of Fossil Fuel Subsidies

Subsidies are intended to protect consumers by keeping prices low. But they also come at a high cost. Subsidies are expensive for governments—and therefore taxpayers—to finance and can hinder governments’ efforts to reduce budget deficits. They also compete with other priority public spending on roads, schools, and healthcare

Explicit Subsidies

Explicit subsidies that cut fuel prices accounted for 8% of the total and tax breaks another 6%. The biggest factors were failing to make polluters pay for the deaths and poor health caused by air pollution (42%) and for the heatwaves and other impacts of global heating (29%).

How Much By Country

Prices were at least 50% below their true costs for 99% of coal, 52% of diesel and 47% of natural gas in 2020. Five countries were responsible for two-thirds of the subsidies: China, the US, Russia, India and Japan. Without action, subsidies will rise to $6.4tn in 2025, the IMF said.

Will Removing Subsidies Help Decarbonisation?

Setting fossil fuel prices that reflect their true cost would cut global CO2 emissions by over a third, the IMF analysts said. This would be a big step towards meeting the internationally agreed 1.5C target. Keeping this target within reach was a key goal of the UN Cop26 climate summit in November 2021.

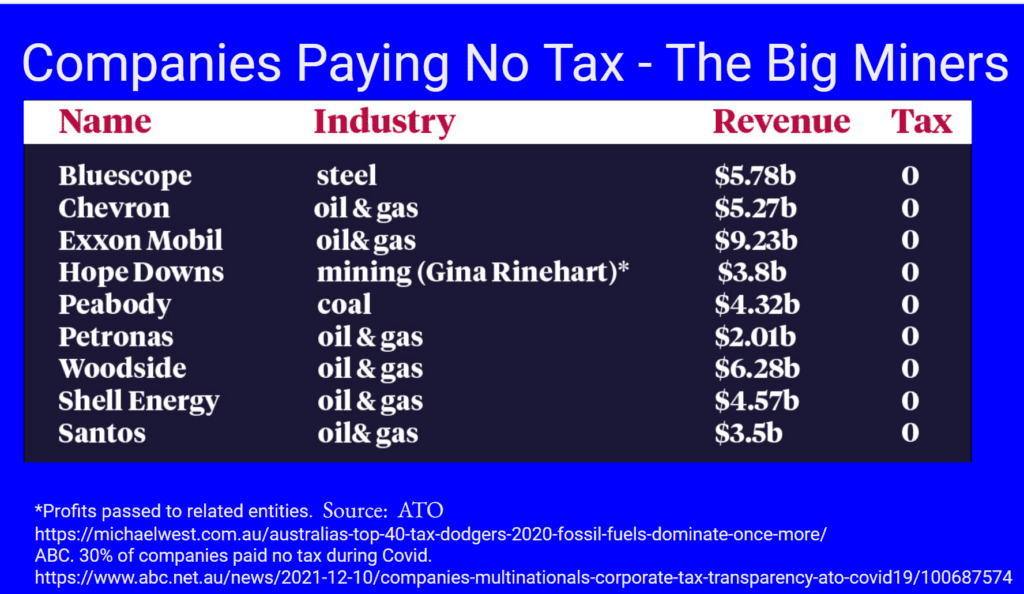

Australian Gas Producer Avoid Tax

While the top 10 fossil fuel companies pay none or nearly zero tax, they claim that the $900m paid in resource royalties are a fair return for a $62billion annual export.

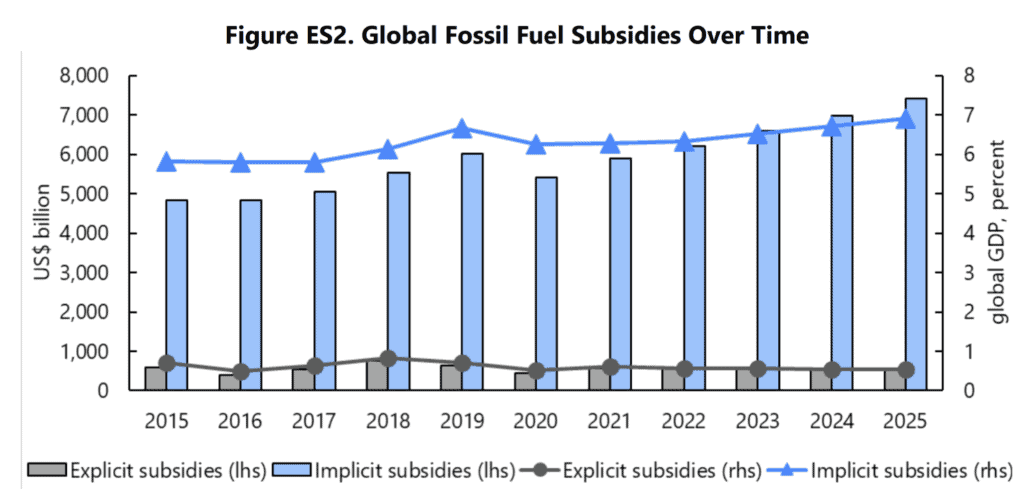

Global Fossil Fuel Subsidies Are Increasing

Figure ES2 in the report says fossil fuel subsidies are expected to rise over the next 4 years from 4.7 Trillion to over $7 trillion

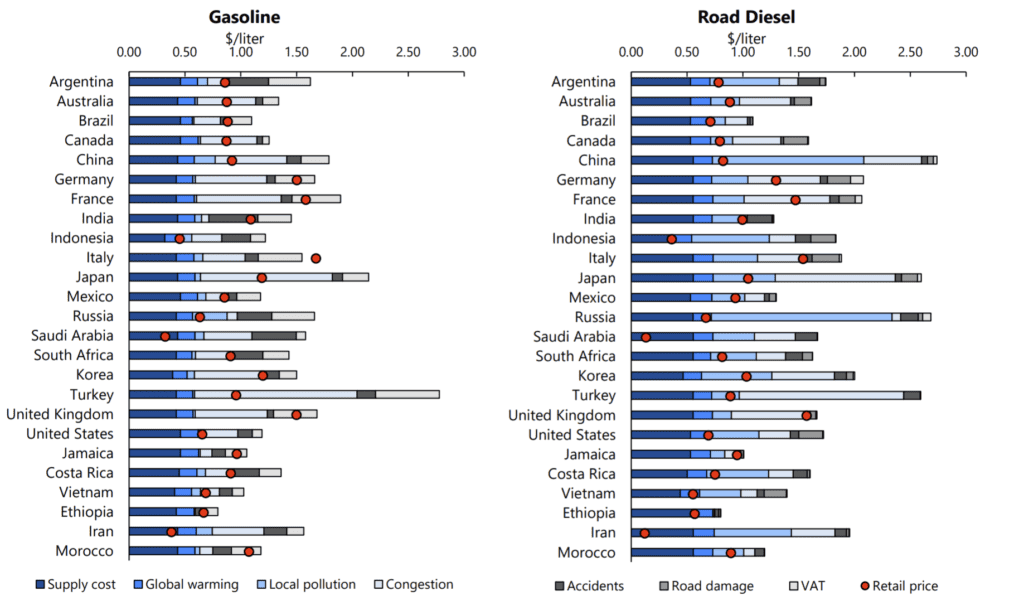

Cost To Consumer Not Market Price

Here is an example where the true cost is not reflected in the retail price. E.g. for Australia, gasoline and diesel does not cover local pollution, congestion or global warming.

Impact In Australia of Fossil Fuel Subsidies

The impact on fossil fuel subsidies of $10.3 billion combined with additional State mining subsidies impacts a range of public services. This is a 2014 report on subsidies (Renew Econcomy) and based over 6 years of subsidies.

Australia Subsidy Breakdown

The Australia Institute break down the subsidies by tax concessions and spending measures

Remediation of Mines

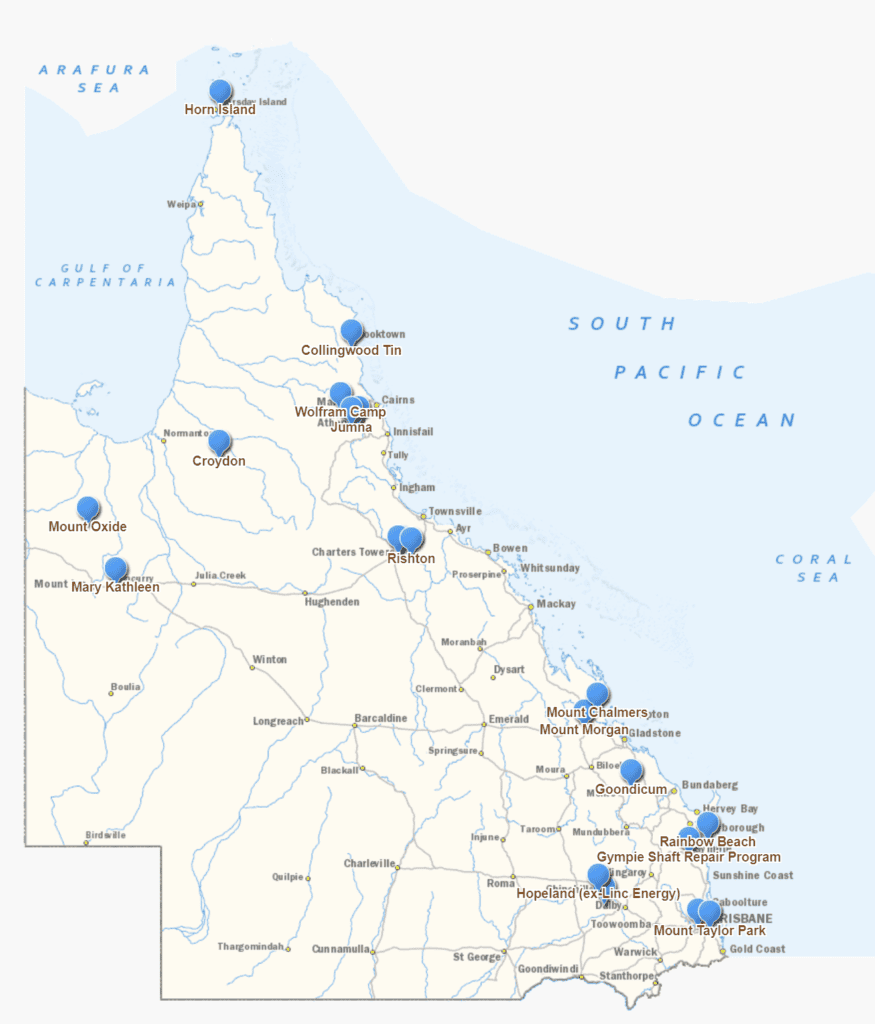

Aside from the direct cost of subsidies, Queensland Govt (Australia) has costs for the remediation of fossil fuel mining activities. (The Govt program of mine remediation is here.)

- Over 220,000 ha of mines need remediation

- 120 Complex abandoned mine sites

- Cost to the taxpayer will exceed $7 billion.

- The formal remediation sites are documented, but there are other sites where the scope and cost are unknown.

- Some, such as Mount Morgan, Mount Oxide, and Hopeland (ex-Linc Energy), are currently managed through the Abandoned Mine Lands Program (AMLP).

- Since 2013, the program has made safe more than 450 mine features at 138 sites.

But the real numbers are much higher. Across Queensland there are over 15,000 abandoned mines where work has stopped and no person or company can be legally required to restore the site (Mackay Conservation)

Some reports say the real cost across Australia is greater than $17 billion (Renew Economy 2016)

Carbon Capture and Storage Subsidy

The case of Chevron Gorgon Project in Western Australia is an example of the level of subsidies. Chevron is a major donor to the Coalition. Since 2010 it has handed more than $1 million to Liberal Party branches, along with $280,000 to Labor branches. Gorgon has also received $60 million in taxpayer subsidies for the failed CCS system.

The Gorgon facility at Barrow Island (report by Institute for Energy Economics and Financial Analysis)

- Promoted as a demonstration of the viability of the technology

- Target of 40% of greenhouse gases – scope 1 and 2 only.

- The biggest carbon capture and storage project in the world.

- It demonstrates how even the simplest and most straightforward applications of the technology, using existing processes, can fail.

- Yet, between first shipment from Barrow Island in 2016 and 2020

- Chevron made $37.6 billion in revenue

- Made $1.6 billion in profit

- Paid zero company tax

- Zero petroleum resource rent tax. (Crikey)

Companies Paying No Tax

Not Paying Royalties

Foreign gas giants Shell, Chevron, Exxon are enjoying an explosion in revenue. They pay virtually no income tax in Australia, and the money for royalties is minor compared to other countries.