The India PV manufacturing targets are ambitious – to be second behind China and to provide sufficient for India and also for a huge export market. The globe needs to decarbonise and the cheapest energy today is renewable energy – wind, solar and batteries. The ongoing reduction in the cost in PV panels provides a threat to coal and gas fossil fuel energy, but also to wind. IEFFA reports in June 2023 India’s policies have been supportive of local manufacturing. Not only has the government tried to curtail PV imports, but it has also taken steps to boost manufacturing through financial incentives.

The government promoted local manufacturing of PV modules through its production-linked incentive (PLI) scheme, with a total outlay of approximately US$3.2 billion over two tranches.

Progress toward India PV Manufacturing Targets

The PLI policy measures are already visible. E.g nameplate capacity for PV cells and modules in India has more than doubled to reach 6.6GW of cells and 38GW of modules in 2023, even though they operate at only 50-60% capacity. India relies on imports of some of the components for PV but will make the change to local manufacturing.

Indian exports surpassed 5x in value terms in the fiscal year (FY) 2023 compared to FY20. Reasons?

- Already sizeable module manufacturing capacity in India

- Restrictions imposed on Chinese goods by other countries.

- Nameplant capacity more than doubled from 18GW in March 2022 to 38GW in March 2023.

India’s Coal Obsession

The headline “India Enters an Unnecessary Coal Plant Permitting Spree in 2023” tells the story that India in pursuing new coal plants will divert scarce resources and hinder India’s renewable energy transition. Politics and corporate interests dominant the energy sector in India.

Media coming out of India demonstrates this political conflict.

The share of non-fossil fuel in the total electricity production during the year 2022-23 and current year (up to May 2023) was 25.44% and 22.45% respectively.

The National Electricity Plan (Generation Volume I) Gazette notified in May 2023, stated the share of non-fossil based capacity is likely to increase to 57.4% by the end of 2026-27 and, and 68.4% by the end of 2031-32. The share of non-fossil fuel-based gross generation in 2026-27 is likely to be 39% and in 2031-32 is likely to be 49%.

India gets over 75% of its power from coal and is building 35 new coal plants (37GW) to go with its 285 existing coal plants. (Bloomberg)

Further Reading

- India Media https://pib.gov.in/PressReleasePage.aspx?PRID=1944696#

- https://www.bloomberg.com/news/articles/2023-06-22/india-plans-to-keep-adding-coal-power-capacity-as-demand-surges

Progress 2022

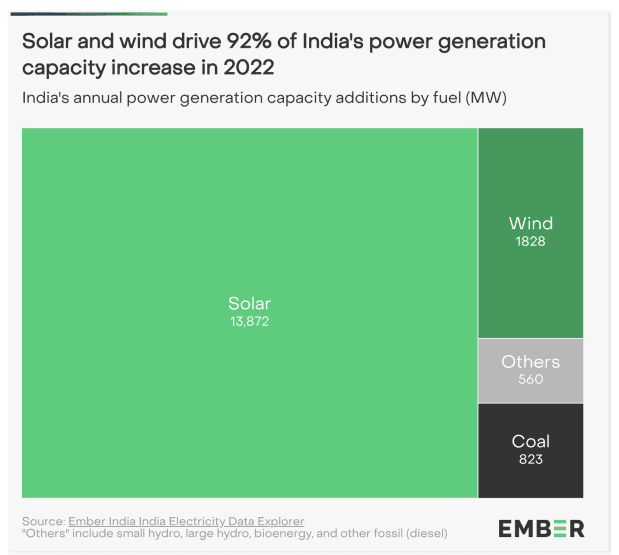

Solar and wind were 92% of India’s generation additions in 2022. It deployed as much solar in 2022 as the UK has ever built. Coal also was down 78%.