Modern batteries such as lithium based technology are expected to provide the mechanism to enable the revolution from petrol and diesel based Internal Combustion Engines (ICE) to Electric Vehicles (EV) and to supply the majority of the dispatchable power in the electricity market globally. This creates a challenge in the supply of the minerals needed to provide those EV and Electricity Network batteries. Minerals include lithium, nickel, graphite, cobalt, and as well some Rare Earth elements used in electric motors, wind turbines, and technology. Lets explore the demand and the supply chains needed to scale the industry at least 30 times or more from the existing supply. (JP Morgan 2022 conservatively says supply needs to growing at 19% CAGR for a decade)

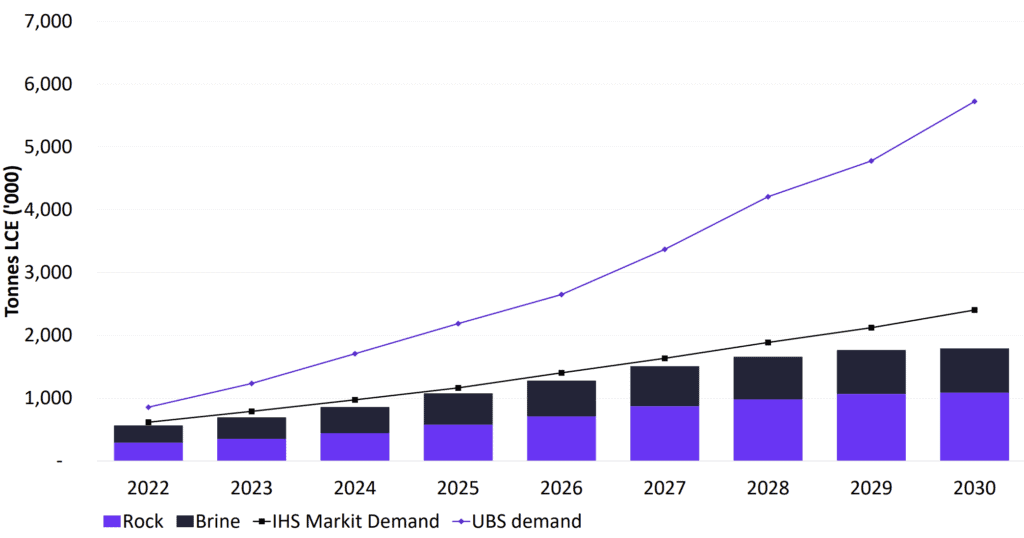

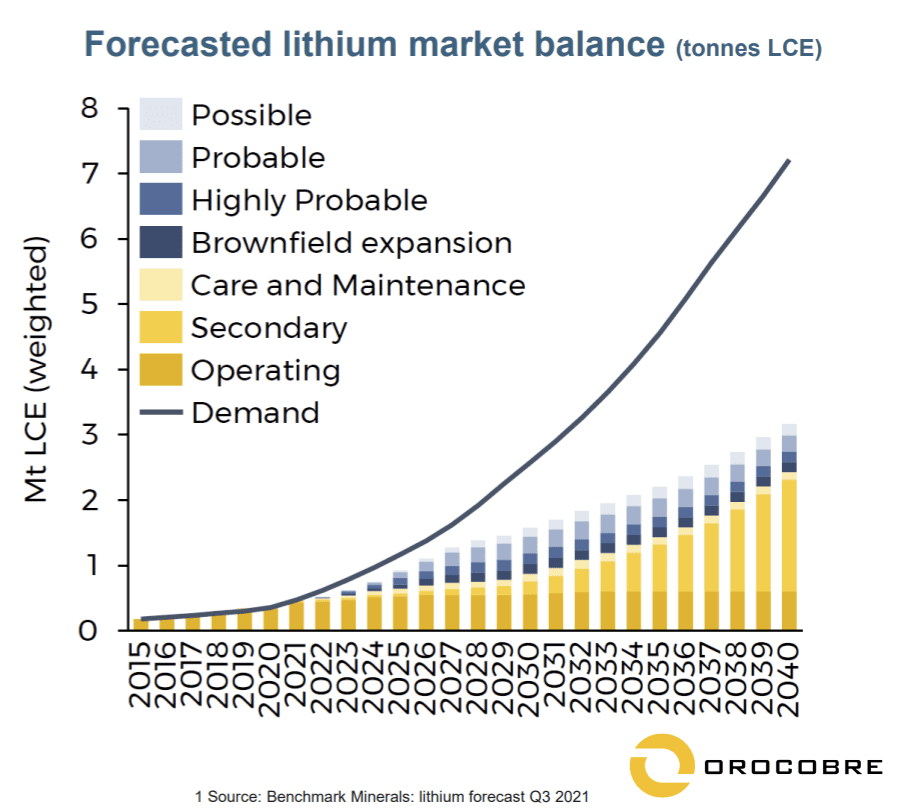

With 63kg of lithium in an 100kW Model S EV battery, and 80 million cars currently manufactured globally, and 60m EVs expected production by 2030, the total demand for EV batteries would be 3.6m tonnes. Current production is about 0.22m tonnes. Lithium mining may need a 20 times to 30 times increase, particularly if the lithium for grid and household storage is included. We have to decarbonise the world to reduce CO2 emissions and batteries provide intermittency control in a renewable energy solution.

Supply Shortage of Lithium for Batteries

“IHS Markit now Part of S&P Global” GWh demand estimates converted into LCE using a 0.8t LCE per GWh factor.

Assumed 130kt LCE demand from Industrial sector. LCE = Lithium Carbonate Equivalent.

Contents

- Technology Overiew

- Battery Demand

- EV Batteries need lithium

- Decreasing battery price

- China dominance

- Challenges facing Supply

- Lithium sources

- EV Battery Chemistry

- Lithium Companies

- Lithium extraction

- Lithium current use

- Mergers and Acquistions

- Lithium Global Sources

- Australian Lithium Companies

- Auto Companies buying Lithium junior miners driving valuations

- Cobalt (article)

- Graphite (Article)

- Nickel (article)

- Alternatives to Lithium Ion batteries (article)

- Rare earth elements (Article)

- References

Technology Overview

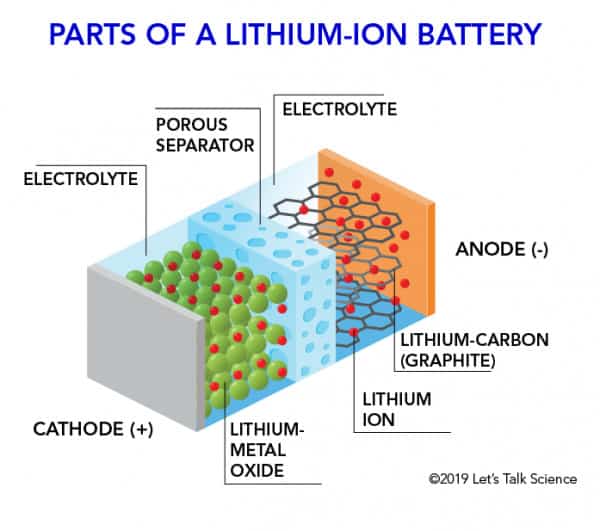

Batteries have 5 components. See Wikipedia for more information

- Anode – almost always graphite, but research to replace with lithium. Recently, two materials have been at the forefront of research for next-generation battery anodes — silicon and phosphorus. Both silicon and phosphorus have a theoretical energy capacity at least 10 times greater than graphite

- Case. Tesla’s new case 4680 (46mm x 80mm) is almost 5 times more efficient and half the price than the current 2170 battery.

- Porous separator

- Electrolyte – using lithium metal, gel or polymer gel

- Cathode – varied. Handheld electronics mostly use lithium polymer batteries (with a polymer gel as electrolyte with a lithium cobalt oxide cathode, and graphite anode

Cathodes include:

- Lithium cobalt oxide (LiCoO2)

- Lithium iron phosphate (LiFePO4)

- Lithium manganese oxide (LiMn2O4 spinel, or Li2MnO3-based lithium rich layered materials, LMR-NMC),

- Lithium nickel manganese cobalt oxide (LiNiMnCoO2 or NMC)

These may offer longer lives and may have better rate capabilities, and different lithium compounds are used.

There is a whole new raft of technologies including solid-state silicon batteries, vanadium redox flow batteries, nickel-metal hydride, lithium-sulphur, NanoBolt lithium tungsten batteries, Zinc-manganese oxide batteries, Organosilicon electrolyte batteries, Gold nanowire gel electrolyte batteries, TankTwo String Cell™ batteries. Some will make it to market – but the 2020 decade will probably be Li-on.

Battery Demand

Decarbonisation has put a rocket under batteries and it is on everyone’s agenda. There will be a bunch of winners and losers. Redwood Materials (JB Strabbel) is in the midstream of supply chain – building cathodes in USA, recycling batteries, and recycling batteries will be another feedstock, but EV batteries are as likely to be repurposed for domestic and community storage for the next decade.

The “S” of Supply Chain

- Secure

- Sustainability

- Strategic

- Scarce

- Supply chain

What Minerals Are Needed?

Lithium is often touted as the biggest demand for minerals – whereas in reality, graphite is the biggest quantity. Value wise though, spot lithium price in December 2021 was about $30,000 per tonne, whereas graphite is about $1300/T. Cobalt probably maybe unlikely as high, due to changes in battery technology.

Global Arms Race for Batteries

Source: Oxford Institute for Energy Studies Feb 2021

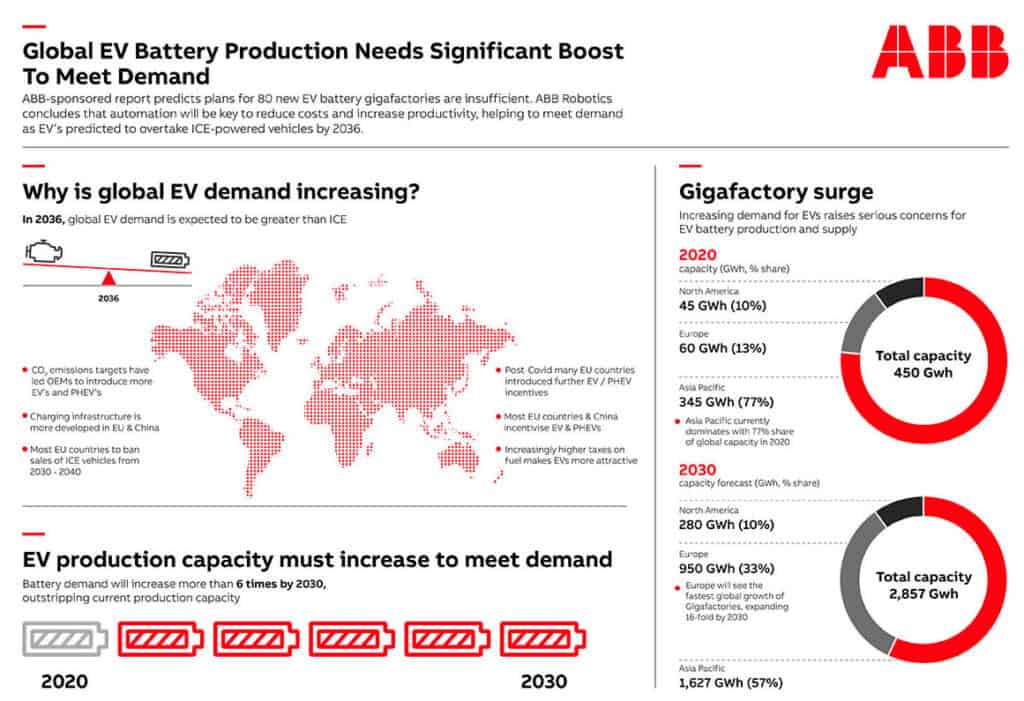

Most predictions show this – eg. ABB infographic

EV Batteries Need Lithium

Amounts vary depending on the battery type and model of vehicle, but a single car lithium-ion battery pack (of a type known as NMC532) could contain around 8 kg of lithium, 35 kg of nickel, 20 kg of manganese and 14 kg of cobalt, according to figures from Argonne National Laboratory.

Surprisingly, lithium accounts for just 4% by weight of the minerals used in a typical lithium-ion cell. Graphite used in the anode accounts for more than half the total mass, and 19% is nickel. Most problematic, at 6%, is cobalt. With cathode of Lithium, Iron Phosphate there is less nickel and no cobalt.

A recent report by Adamas Intelligence shows that Tesla deployed 18,700 tonnes of lithium carbonate equivalent onto roads globally in 2020 in the batteries of its newly sold passenger EVs. That was for 500,000 cars. i.e. 36kg per car.

At 37kg per car, and 80% of new cars by 2030 BEV that is 50m x 37kg is 1.8 million Tonnes.

For stationary storage then the quantity of LiCO3

- The best estimate is around 160 g of Li metal in the battery per kWh of battery, or if you prefer, about 850 g of lithium carbonate equivalent (LCE) in the battery per kWh

- With 1TWh then that is 160,000 tonnes of lithium or 860,000 tonnes of LiCO3

Arizona Lithium says 10x more is needed for the 200 Gigafactories, but others say more like 30x is needed.

Nissan announced a change to EVs in Nov 2021.

- By 2026 to have 690,000 vehicles sold, which takes 52GW (at 75kW per car)

- Bu 2030 to have 1.3m vehicles EV. That needs 130GW.

Decreasing Battery Prices

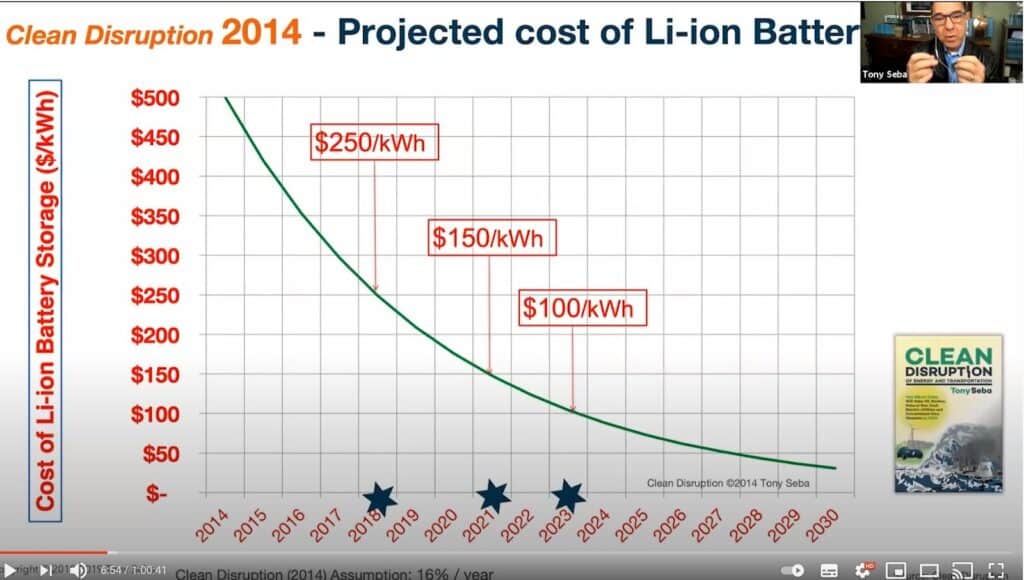

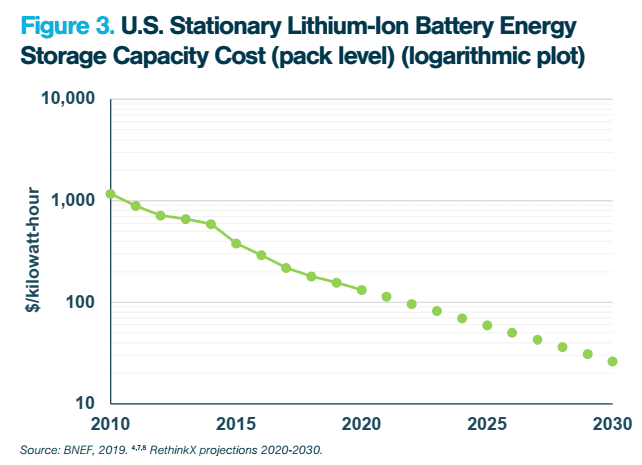

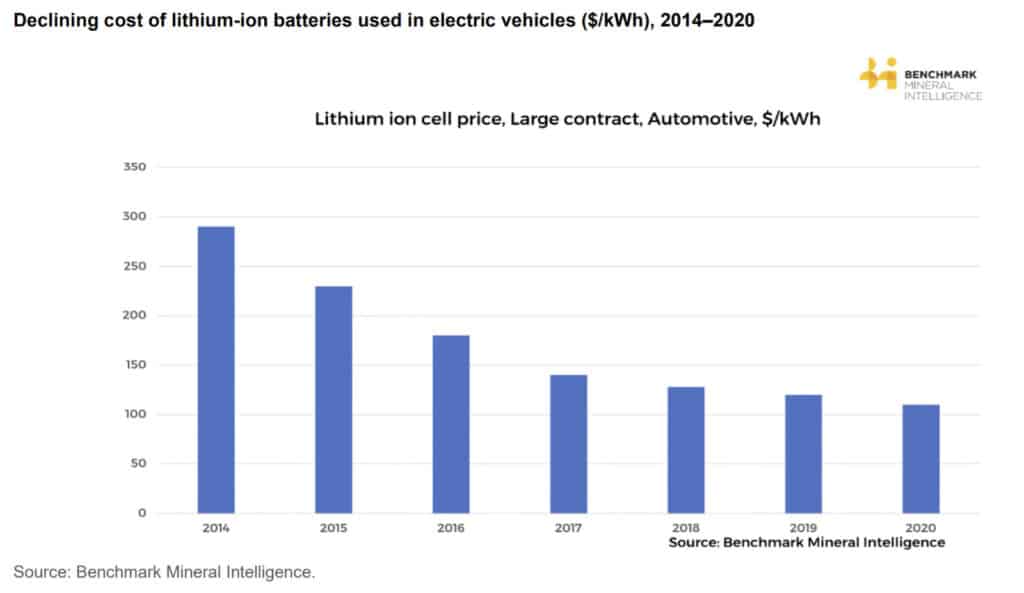

Along with the extra demand, the cost of batteries has been coming down by 20% per year. Given the predicted ongoing price reduction, the demand for batteries is likely to be even higher than the 3TW predicted.

Projection by RethinkX costs decrease from $100/kWh to $30/kWh by 2020. Costs have decreased 87% from 2010 to 2020, and a further decrease by 80%. I.E. a 80x reduction in 2 decades

China Dominance

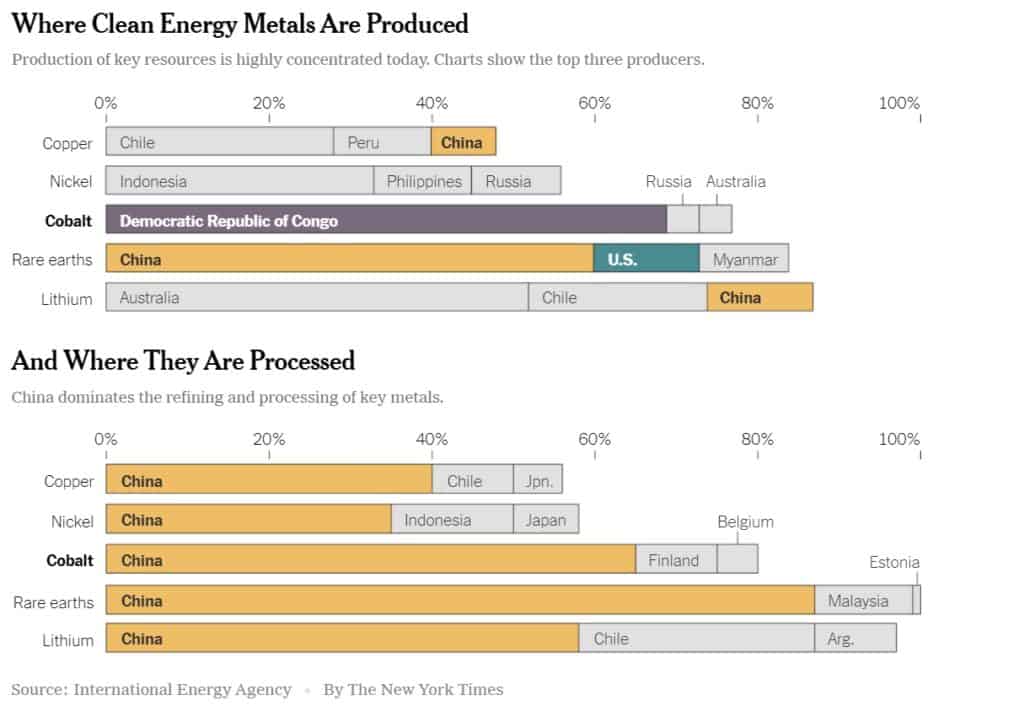

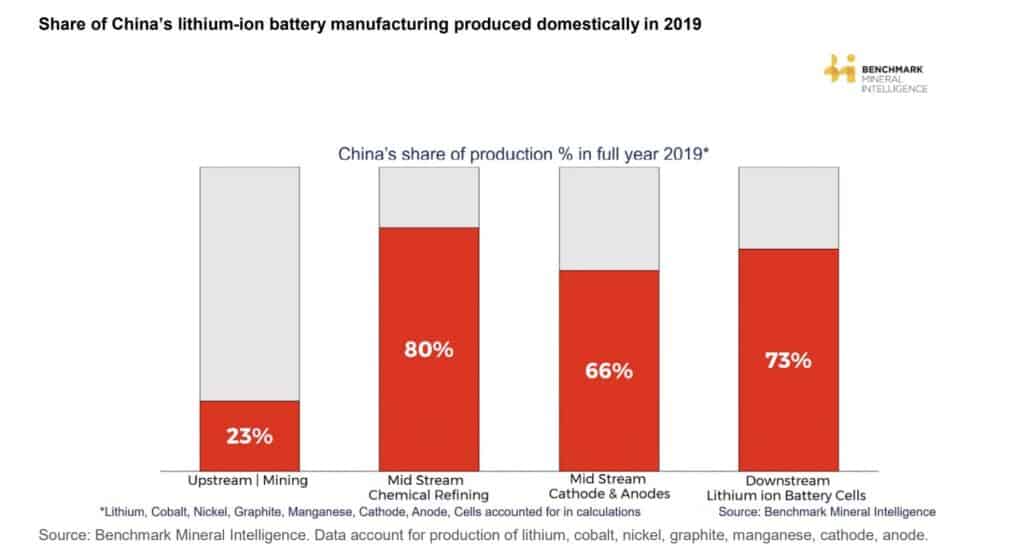

While China only domestically mines 22% of its battery raw materials, it domestically produces 66% of this chemical stage, ensuring the global supply chain arrows point towards China. China’s lack of domestic battery raw material production is compensated by mid-stream supply chain dominance. This is also a strategy to ensure strong battery cell and EV production share.

Most Chinese companies have expanded globally to get production. Eg Ganfeng has the 2nd largest Spodumene mine in Australia at Mt Marian, out of Kalgoorlie. (Ganfeng website) producing about 450,000 tonnes of spodumene pa. The JV partner is Mineral Resources (MIN:ASX)

Challenges Facing Supply

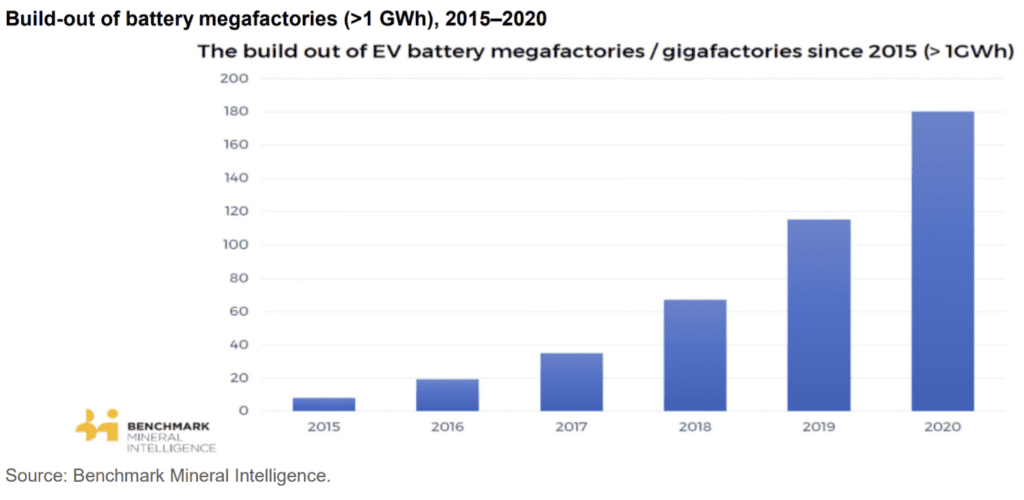

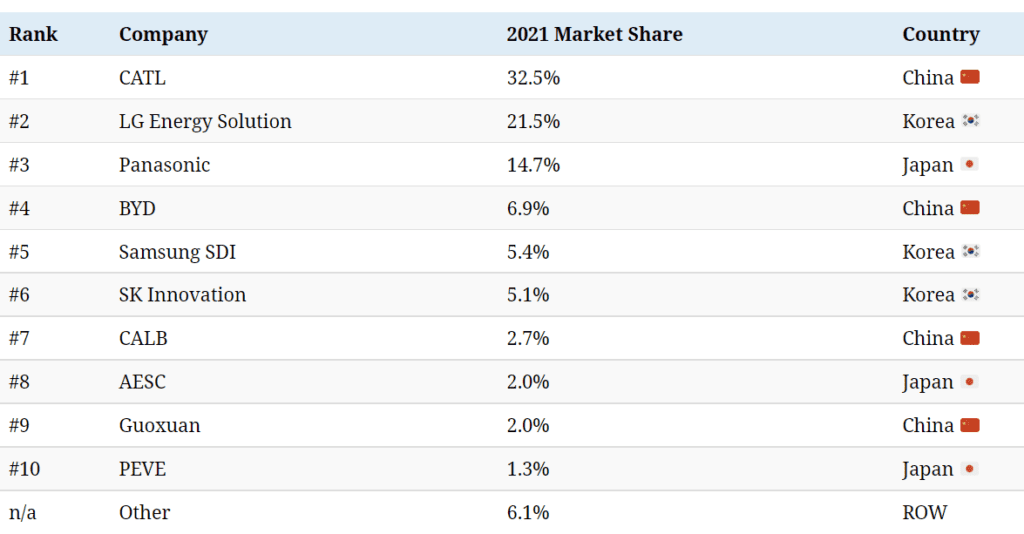

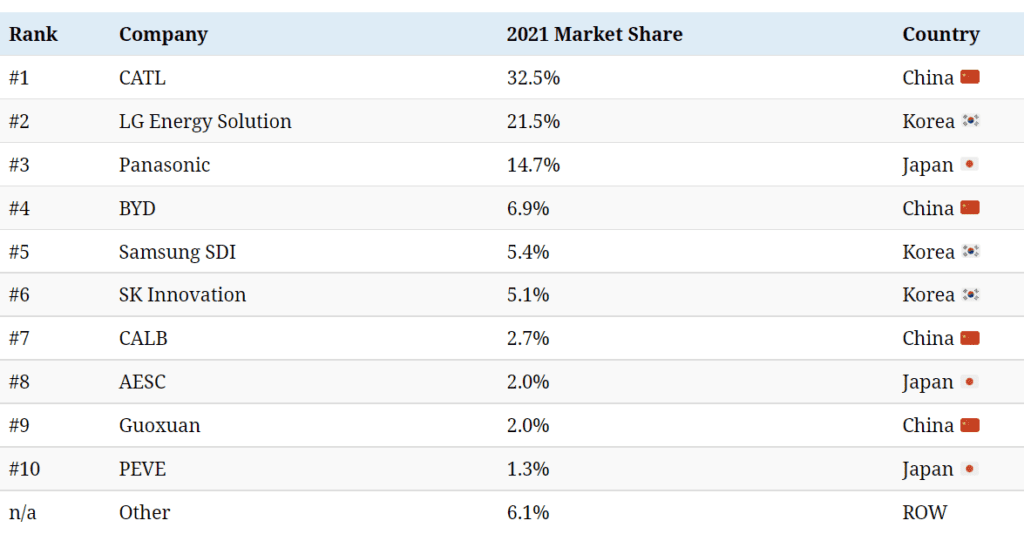

Given the numbers above, with over 500 GW in USA by 2030 and 3TW globally, how is the supply actually resolved. Three companies are 70% of batteries. Panasonic, CATL & LG.

Contemporary Amperex Technology Co. Limited (CATL) has risen in less than 10 years to become the biggest global battery group. They provides lithium iron phosphate (LFP) batteries to Tesla, Peugeot, Hyundai, Honda, BMW, Toyota, Volkswagen, and Volvo, and shares in the company gained 160% in 2020, lifting CATL’s market capitalization to almost $186 billion.

The industry is growing.

- Cathode producers are too small and too slow

- Commodities for all components are restricted in supply

- There are many innovations but they are likely to take a decade to get to volume production

- Over the past 6 months, Tesla has changed from Lithium Nickel Cobalt to Lithium Iron Phospate batteries from CATL, but their LFP patents are expiring.

- LFP are not as dense and as batteries are heavy, importing goes against supply

- Short supply for next 5 years or more

Lithium Sources

It looks like lithium and lithium hydroxide are here to stay, for now: despite intensive research with alternative materials, there is nothing on the horizon that could replace lithium as a building block for modern battery technology over the next decade. Vanadium flow batteries will be ok

- LFP requires lithium carbonate anode LiFePO4

- Li high nickel requires lithium hydroxide Li(H2O)n

In hardrock lithium deposits, there often is petalite and it is similar to spodumene

- Petalite – LiAlSi4O10

- Spodumene LiAlSi2O6

Petalite has a lower lithium content of 4% but also generally has very low iron content. This can be used in the battery supply chain; however, it has greater value potential within the glass and ceramic industry. Petalite has several advantages over spodumene and lithium carbonate, including being priced on a ‘value in use’ (VIU) basis (silica and alumina is paid for), it lowers the temperature of the glass furnace (reducing maintenance costs) and it has low iron content.

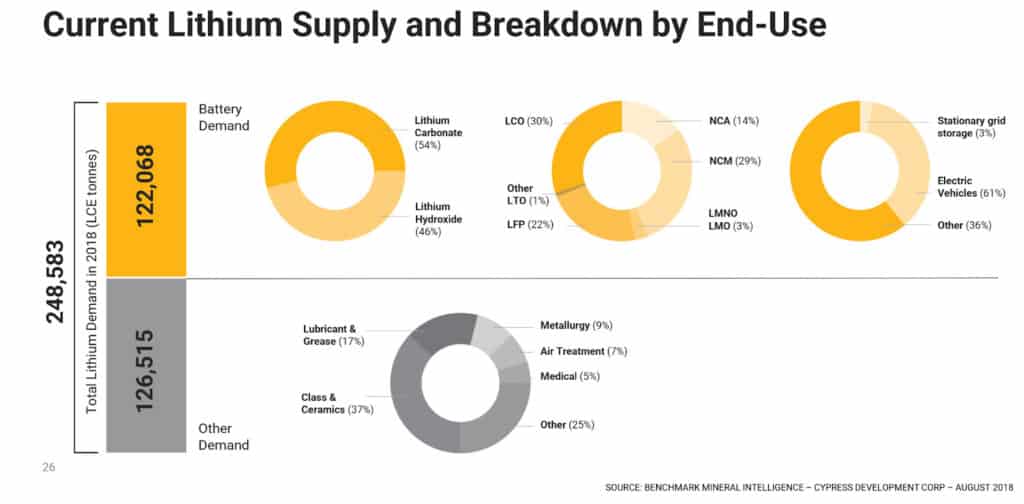

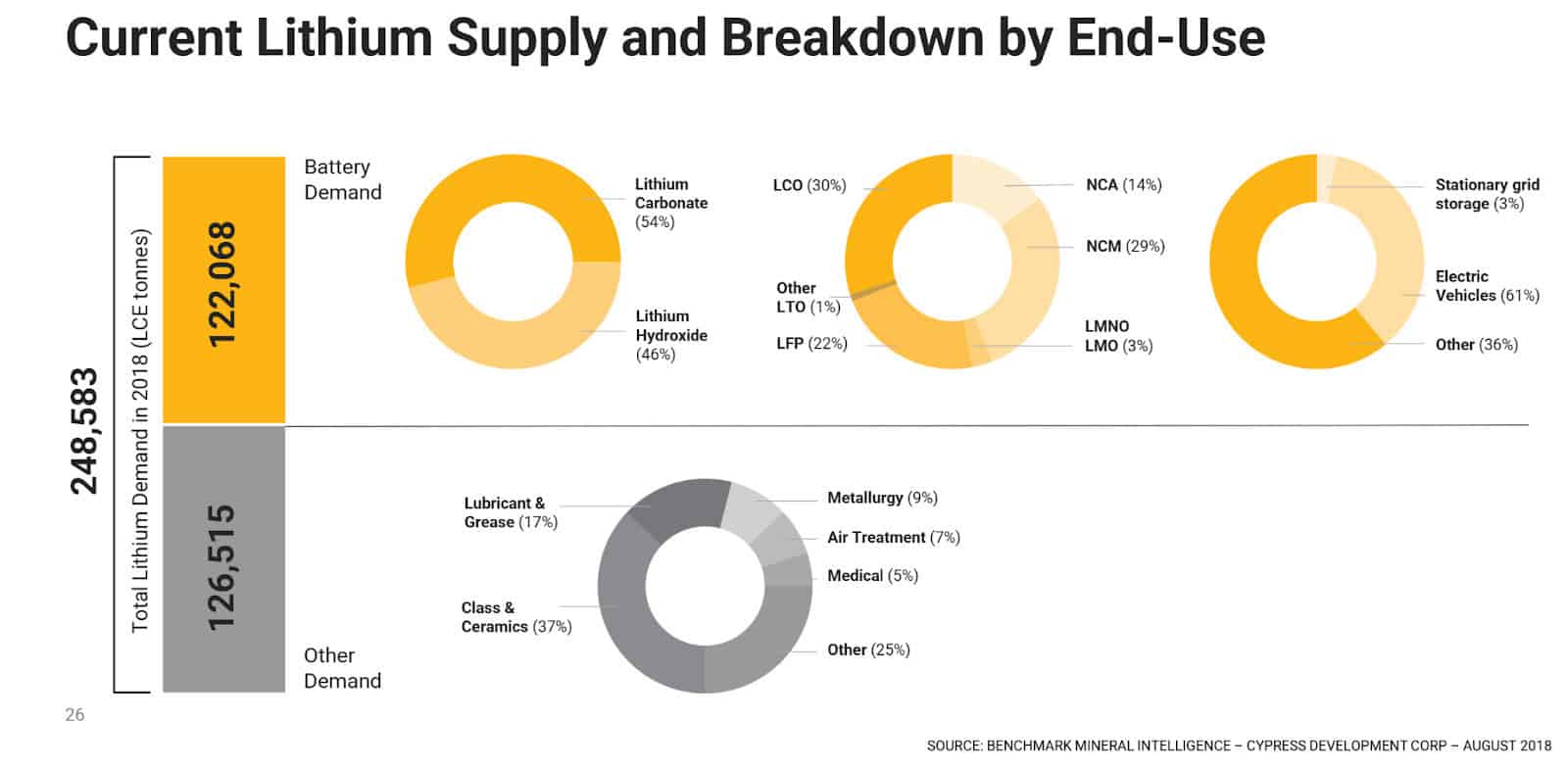

Lithium carbonate accounted for around 60pc of lithium demand in 2018, but battery technology development is increasing demand for lithium hydroxide, which is expected to account for a larger share of the market by 2024. Demand for lithium carbonate is expected to rise at a compound annual growth rate (CAGR) of 10-14pc in 2018-27, while lithium hydroxide demand is seen rising at a 25-29pc CAGR.

EV Battery Chemistry

Battery chemistry is defined by the anode (currently graphite) and the cathode. Small consumer batteries in phones and computers are mostly all Nickel Cobalt Manganese (NCM). In mid 2021, the sale of of lithium iron (LFP) phosphate batteries for electric vehicles in China surpassed the incumbent NCM/NCA chemistries for the first time since the start of 2019.

In batteries with LFP chemistry, phosphate serves as the cathode material. NCM (lithium nickel cobalt manganese) batteries use a combination of nickel, manganese, and cobalt for the cathode, while NCMA (nickel, cobalt, manganese, aluminium) chemistry features a 90% nickel cathode.

Because iron and phosphate are more common than cobalt and nickel, LFP batteries are ~$US18 cheaper than NCM/NCA per kWh to manufacture (SNE Research). The downside is that they have lower energy densities which makes them unsuitable for longer driving ranges. That is not really an issue for the stock standard work commute though, which explains their popularity.

Lithium hydroxide has a higher energy density, and cathodes do not need cobalt.

Prices are driven by demand and supply. It may be the future of NCM [nickel-cobalt-manganese] batteries looks less promising than that of LFP [lithium-iron-phosphate] batteries, so demand for lithium hydroxide is weaker than that of lithium carbonate.

Lithium Companies

There is a lot of consolidation in the mining sector. E.g Zijin Mining Group Co. Ltd, a Chinese multinational mining behemoth purchased Canada’s Neo Lithium for $770m. Neo Lithium had spent 50m getting to the process, and such purchases are likely to increase. It often takes 4 to 8 years to get new deposits ready to mine.

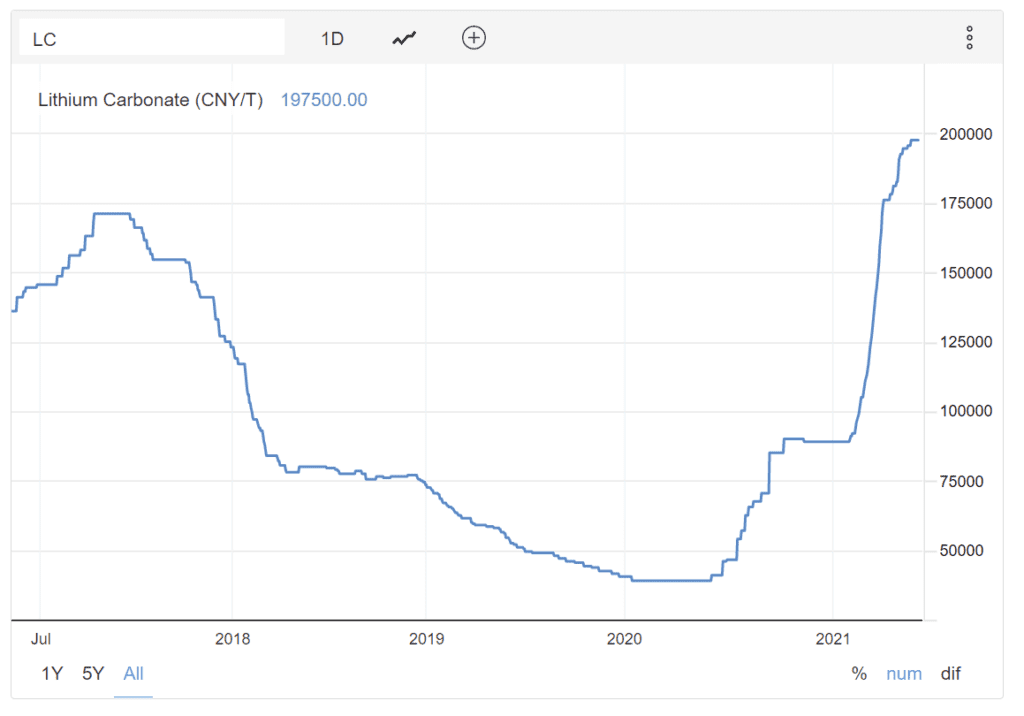

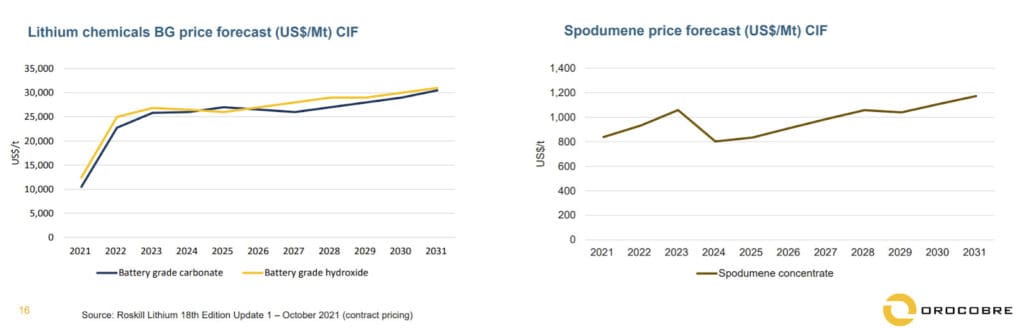

Jiangxi Ganfeng Lithium Co. Ltd. and CATL have gone to Africa or Australia to pick up mines. One could expect a bunch of junior lithium minors that are $50 to $250m million companies go to $1 billion value as the spot prices have risen 4 times this past year. Current spot prices 25,000 to 30,000 – price might go to 40,000 (Spodumene used to be at $800/T but now up to $1500 to $2000 per tonne). Spot prices are not long term contracts, e.g. Tesla buys from Abermarle on a long term contract but as contracts renew, there are likely to be no depressed prices as per the last 2 years.

Lithium prices (CNY) – at 200,000 RMB is $31,000 lithium pricing based on spot prices for Lithium Carbonate, 99.5% Li2CO3 min, battery grade, traded in China.(Trading Economics)

Orocobre says that average pricing for the December quarter is estimated at $US1,650 per tonne – “almost double the September quarter average.” Their cash cost of production was $351/T FOB.

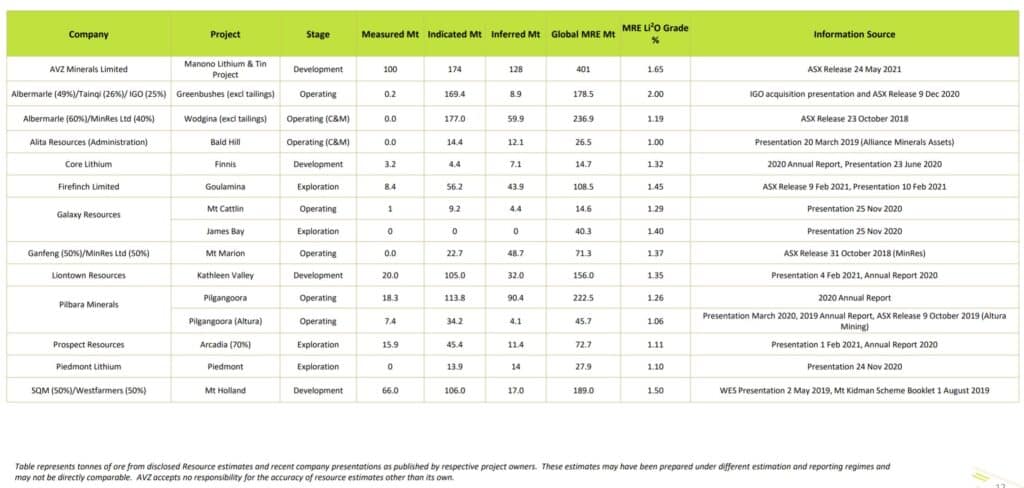

Example of Resources and Lithium %

| Location | Lithium concentration | Source |

| Ocean | 0.17 mg/L (0.00017 g/L) | Seawater |

| Clayton Valley, Nevada | 300 mg/L (0.30 g/L)[15] | Shallow brine beneath dry lake |

| Cornwall, United Kingdom | 220 mg/L (0.22 g/L)[16] | Geothermal waters |

| Paradox Basin, Utah | 142 mg/L (0.142 g/L)[17][18] | Brine at depth (Cane Creek well) |

| Salar de Olaroz mine, Argentina | 690 mg/L (0.69 g/L)[12] | Shallow brine beneath dry lake |

| Salton Sea, California | 270 mg/L (0.27 g/L)[19] | Geothermal brine |

Conversion minerals to Lithium Carbonate Equivalent

| Type | Product | Lithium Contained | Conversion to LCE |

|---|---|---|---|

| Chemical | Lithium Metal | 100 | 5.319 |

| Lithium Oxide (Lithia) | 46.4 | 2.468 | |

| Lithium Carbonate | 18.8 | 1.00 | |

| Lithium Hydroxide Monohydrate | 16.5 | 0.878 | |

| Lithium chloride | 16.3 | 0.867 | |

| Minereals | Spodumene (6% Li2O)) | 2.8 | 0.149 |

| Petalite (4%Li2O) | 1.9 | 0.099 | |

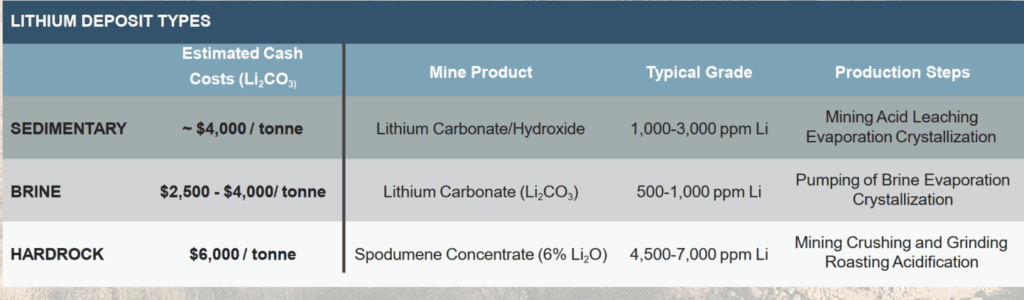

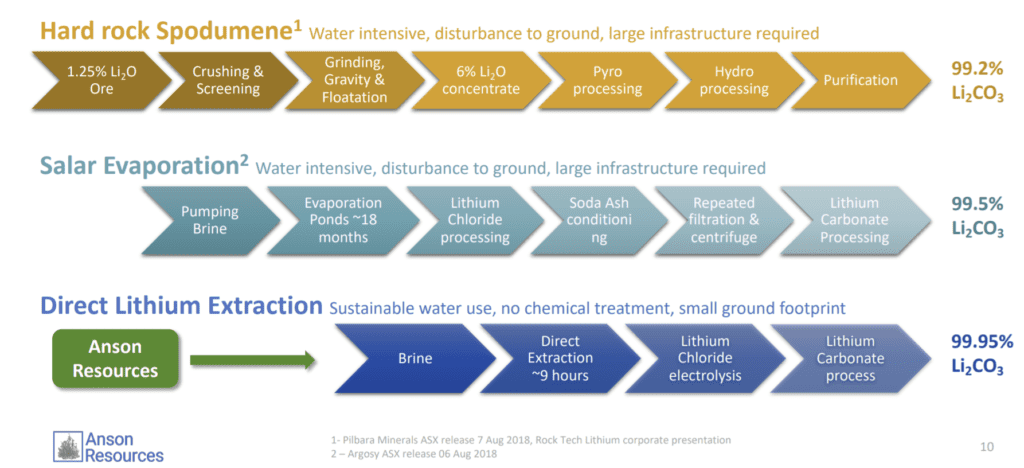

Lithium Extraction

Lithium is extracted in 5 primary ways currently but other techniques are under review

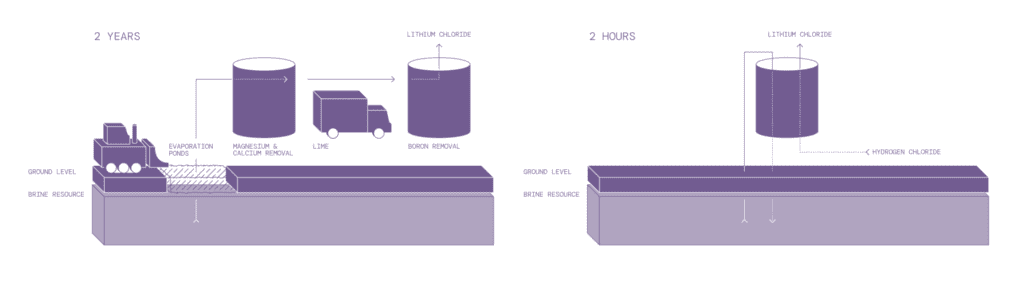

Brine Solar Extraction

The triangle area of Argentina, Chile & Bolivia has rich resources. Southern California has some deposits. (Salton Sea) Mining in the salt flats occurs through a process of brine extraction, which involves a lengthy procedure of up to 18 months. Mineral-rich brine is extracted from beneath the salt flats, and subsequently, undergoes a process of evaporation to separate the lithium from other minerals. Primary lithium is Lithium hydroxide. Includes Abermarle. Salton Sea ran out of money, and All American lithium, Terralithium, and Energy Source Minerals and Berkshire Hathawy Renewables are using DLE methods. Galan has partnered with

Hard Rock Extraction

At hard-rock operations, ore is extracted, usually from pegmatite deposits, using conventional mining techniques before it is concentrated via crushing, dense media separation and sometimes flotation to produce a concentrate Lithium carbonate can then be further treated to create lithium hydroxide. Australia is mostly hard rock, and the area in the USA is east triangle.

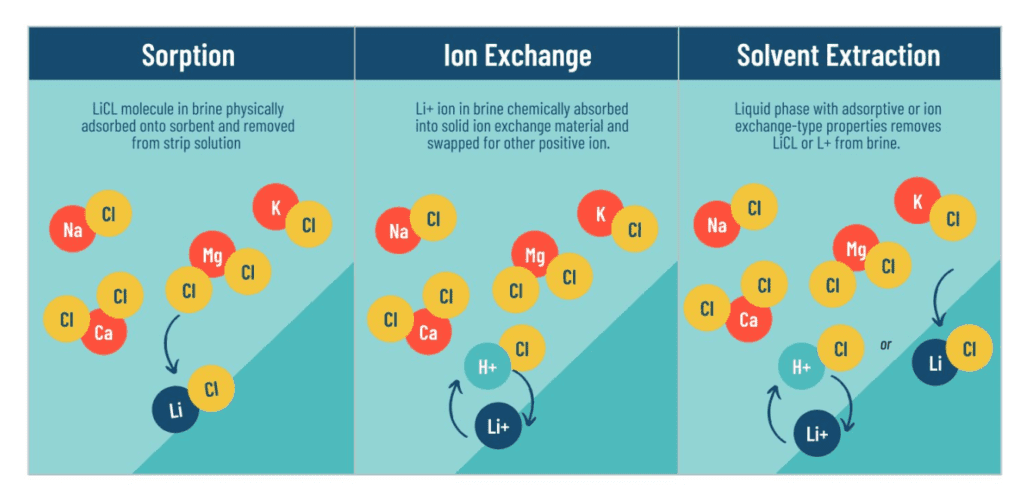

DLE – Direct lithium Extraction

DLE techniques are in preproduction mode – using membranes, or ion exchange techniques instead of brine solar extraction.

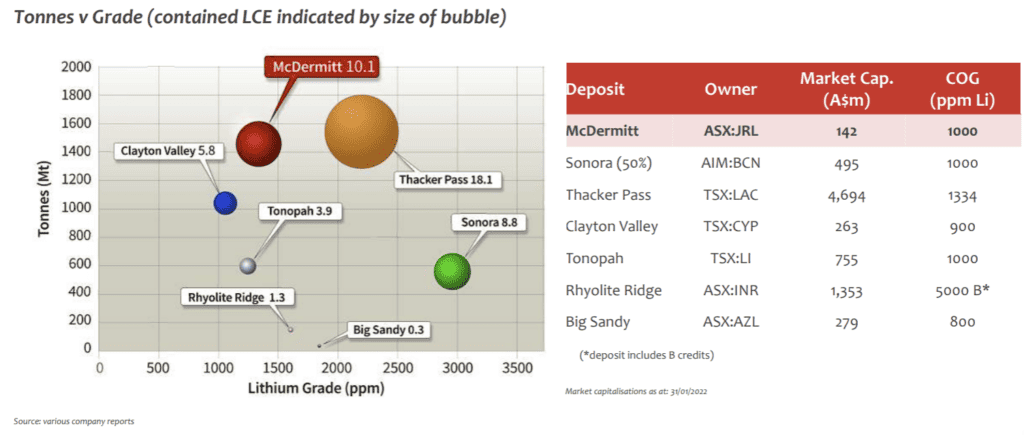

Clay Deposits.

Lithium can also be extracted from lithium clays (hectorite) The commercial-scale production of lithium from clays is yet to be realised – see activity in Oregon and Nevada from clay or sedimentary deposits. E.g Cypress, Lithium Americas, Ioneer.

Here are the various companies with clay deposits

Geothermal – Petrolithium

Petrolithium is a new approach that focuses on concentrating lithium and other elements from abundantly available wastewater (brine) that accompanies oil and gas production. Vulcan is one such who are looking to do DLE on geothermal brine – using the geothermal for zero energy, extracting the lithium using DLE methods and putting the waste brine back into the geothermal vent.

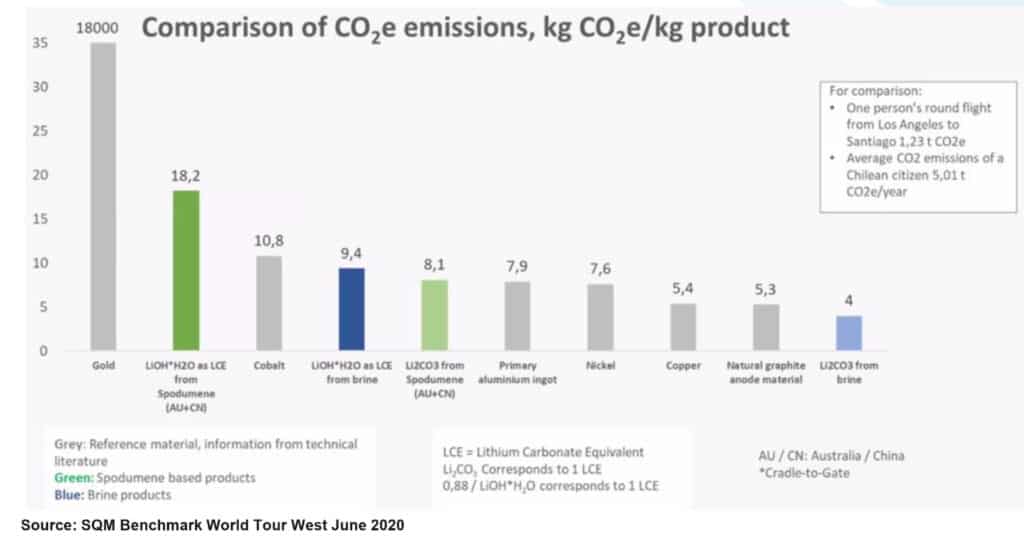

There is some cognitive dissonance and there is a need to get agreement that EV and batteries require mining for lithium, graphite, nickel, cobalt

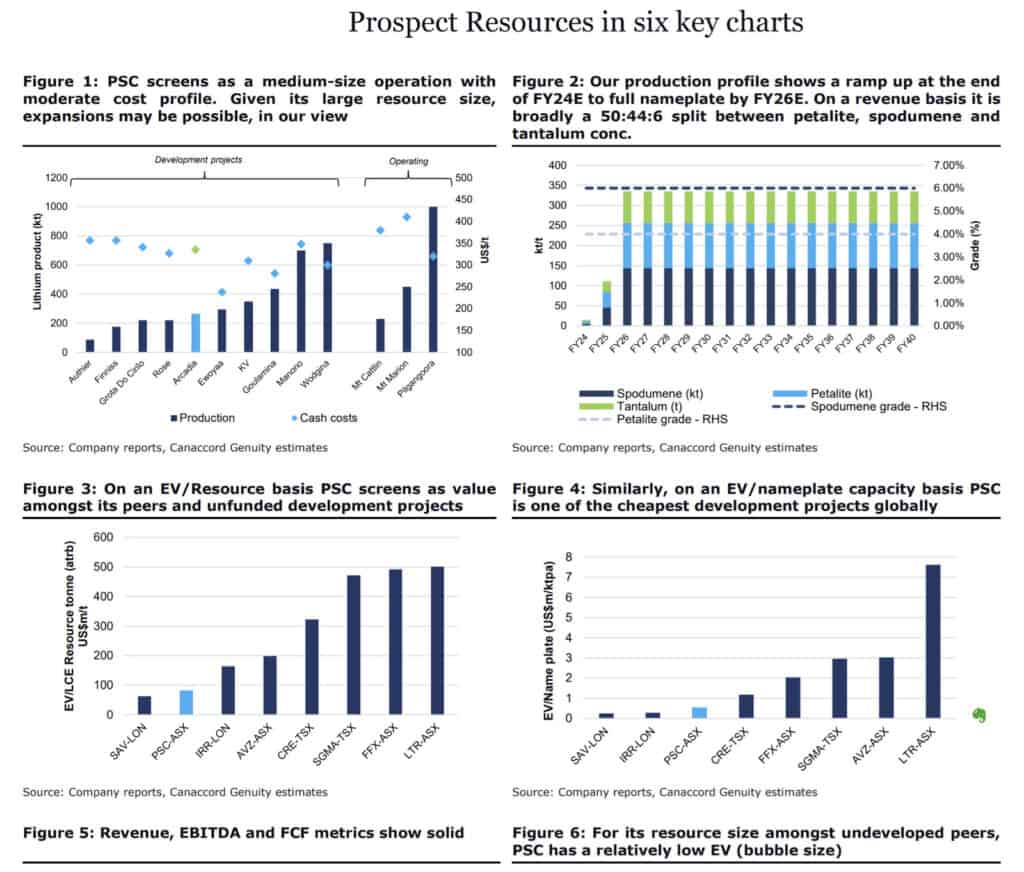

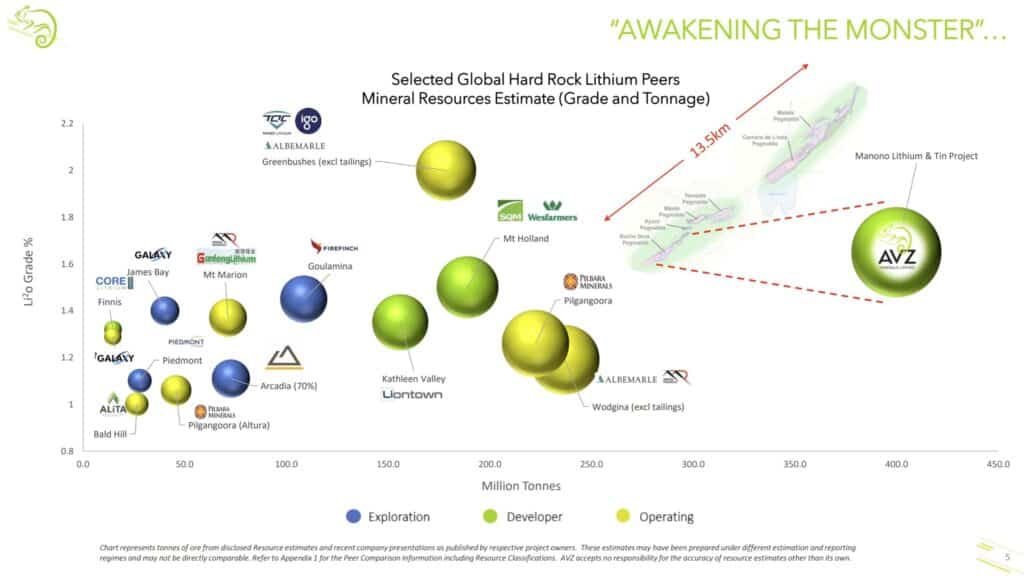

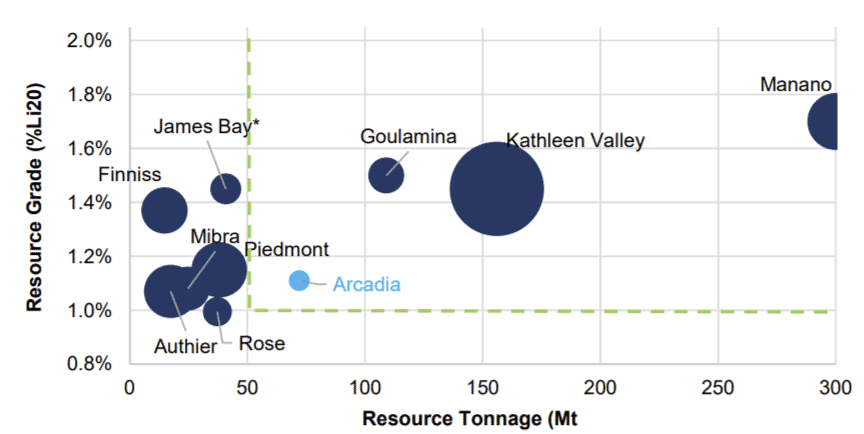

Extraction Process Comparison

Various reports show reserves and value of different exploration companies. They range from 10 million tonnes to 400 million tonnes (in Congo) and from 1% up to 2.2% Litihim grade.

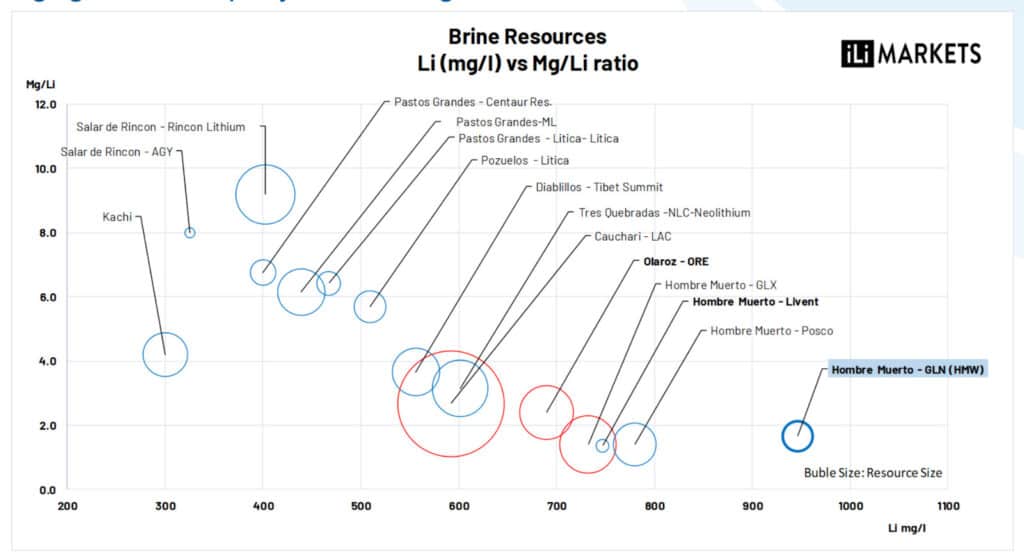

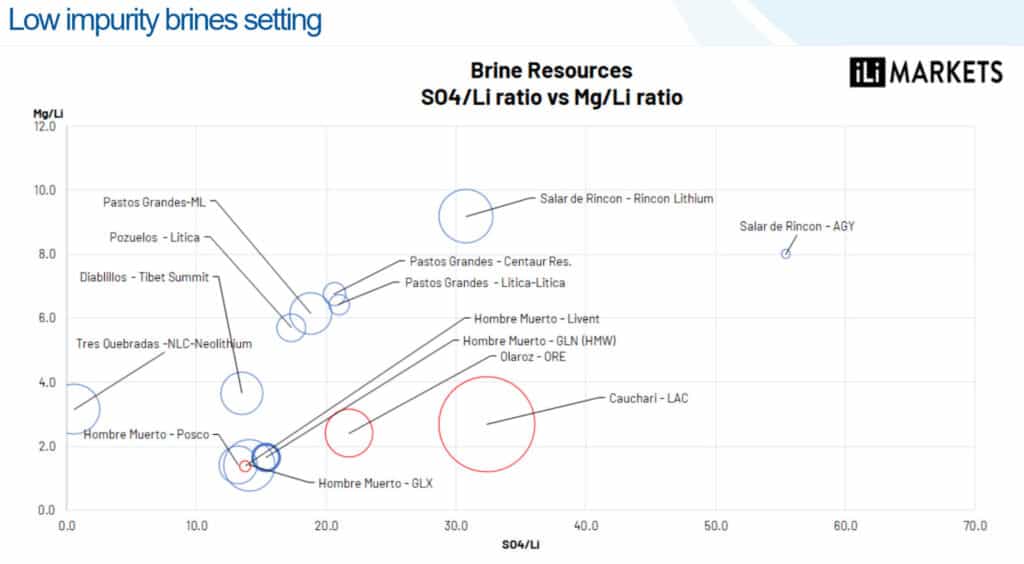

From Argentina

Low Carbon Extraction will become important

Lithium For Batteries Current Use Breakdown

Mergers and Aquisition

Recent lithium M&A are increasing in number and value.

- Albermarle Corporation’s US$820m acquisition of a 60% interest in Mineral Resources Limited’s Wodgina project in Western Australia and transfer of 40% of 50ktpa LiOH plant in Kemerton (Aug 2019)

- Gangfeng Lithium buy a 30% stake in Bacanora Minerals Ltd (May 2019)

- Wesfarmers (A$776m) takeover of Kidman Resources Ltd (May 2019))

- Ganfeng’s US$160m investment in Lithium Americas (April 2019)

- PlusPetrol’s C$111m acquisition of LSC Lithium (March 2019)

- Galaxy Resources Ltd sale of northern tenements in the Sal Da Vida Project in Argentina for US$280m to POSCO (March 2019)

- Pilbara Minerals acquisition of Altura’s Pilgangoora Lithium Project for US$175m, via A$240m equity raising (December 2020)

- IGO Limited acquisition of 49% non-controlling interest in Tianqi Lithium Energy Australia Pty Ltd, A$766m equity raising and A$1.1billion new debt facilities (December 2020)

- Pilbara Minerals Limited acquisition of Altura Lithium Operations Pty Ltd by (December 2020)

- The proposed merger of Orocobre Limited and Galaxy Resources Limited (April 2021) with the new compan to be called AllKem.

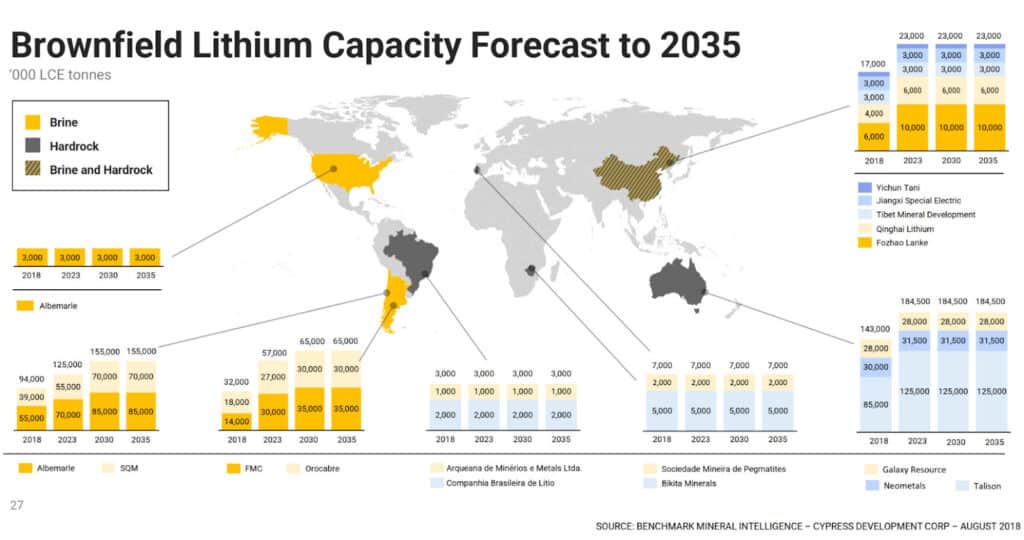

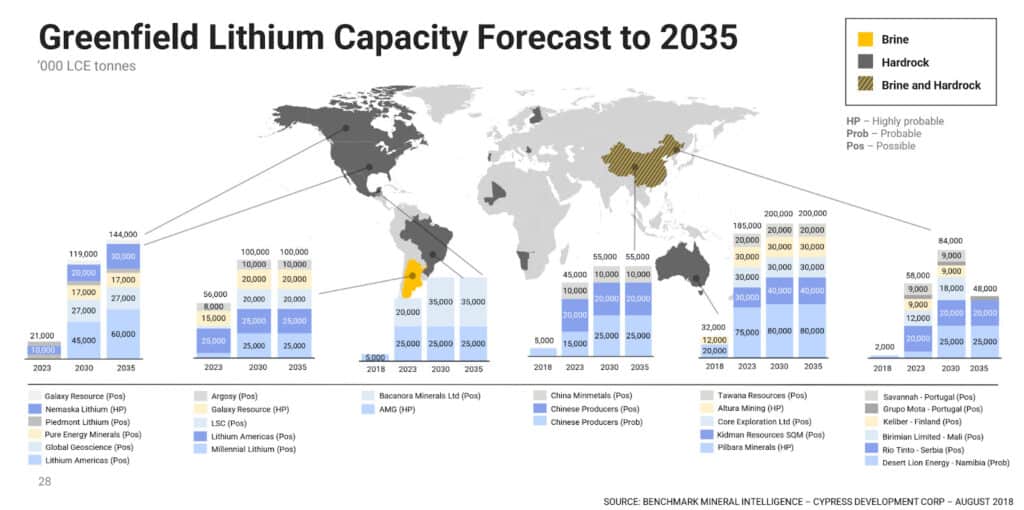

Lithium Global Sources

There are existing miners – these are the brownfields, and then there are a whole lot more greenfield sites. See Cypress Nevada AGM presentation.

Even with these new sites, the total capacity of LCE is less than 1m tonnes.

Supply shortage

Source: Orecobre Annual Report Nov 20, 2021

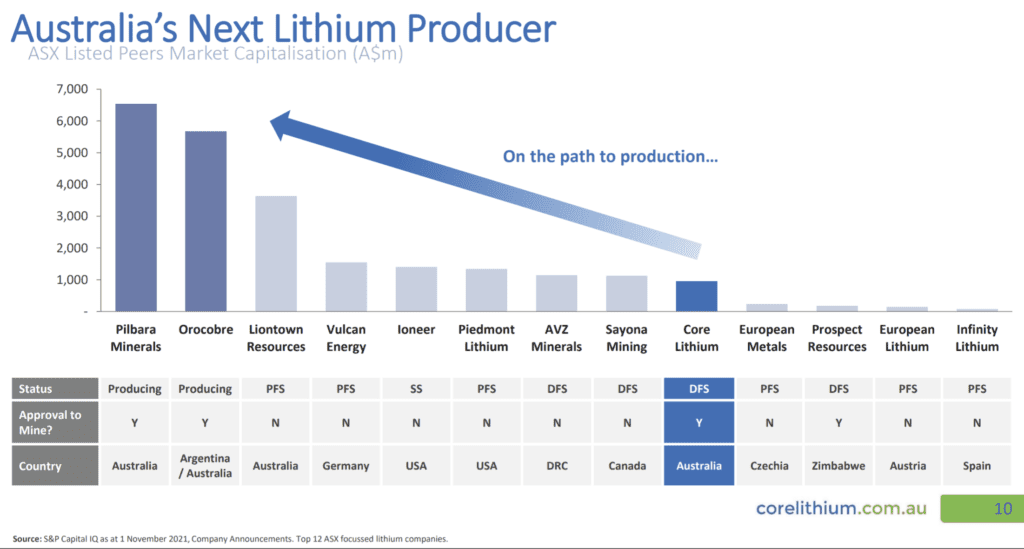

Australian Lithium Companies

The 2 largest operations are in WA. The worlds second largest spodumene lithium mines (Ganfeng / Mineral Resources 50/50) is at Mt Marion, but another at Wodgina Lithium (Albemarle 60% / Mineral Resources 40%) in the Pilbara was recently been restarted due to the global price of lithium, and the lithium is shipped to the updated extraction plant at Kemerton south of Perth. Lithium hydroxide modules, when complete, will be capable of processing the spodumene produced at Wodgina – some ¾M tonnes at 6% LiCO3. The Joint Venture will assess the optimal use of the Kemerton Modules and processing of Wodgina spodumene.

For a full list checkout out Stockhead Listing or download a Google Sheet here.

Acquisition Example – Will Auto Makers Buy Miners?

Ford Motor Co. in Sept 2021 announced plans to invest $11 billion to build several new plants to produce parts for electric vehicles, creating nearly 11,000 jobs.

- Allows for a new assembly plant to build all-electric F-Series trucks

- Three battery plants, including factories in Kentucky and Tennessee.

- Ford had previously announced an investment over the past two years of $950 million in the Rouge Complex in Dearborn, Michigan, to build the all-electric 2022 F-150 Lightning.

- $7 billion from Ford and about $4.4 billion from its joint venture with battery partner SK Innovation of South Korea.

- They say they need 129 GWh per year.

- Technology is lithium Nickel so they will need 100,000 to -125,000 tonnes Lithium Carbonate per year.

- At a purchase price of $20,000 per tonne, that’s $2b a year.

- Over 20 years that’s over $40b.

Alternative Scenario – they buy the supply chain.

- To secure their supply, they buy 4 miners.

- Each miner has 25 years of reserves and production capacity for 40 MT per year.

- Assume they buy them for $2.5b

- Still would need fund about $1b to get a processing plant.

- The cost of production is about $5,000 -$7,500 per tonne

- Purchasing the miners and doing it themselves, will save them $25b over 20 years

- If the price of lithium increases more, they save even more

Expect that in 2022, we see either battery or car company will buy multiple lithium mines that are close to production and large cheques are being written. At a $200m market cap they will be a steal, and and even at 1billion will be still worth buying.

References

The Oxford Institute for Energy Studies Feb 2021 (PDF)

CleanTechnica Talk Nov 2021 Supply Chains and Talk (RK Equity cofounder Howard Klein RK Equity talks with CleanTechnica CEO Zach Shahan about nickel mining, green graphite versus dirty graphite, lithium supplies, & US EV battery policy potential.

Lithium hydroxide demand to overtake carbonate (Argos Media)