The offshore wind technology opportunity is expected to grow 10 times or more from the 18GW in 2019, to over 228GW by 2030 and 1000GW by 2050. Renewable energy is a technology, not a fuel. Like most technologies, the cost of wind has decreased about 8% year on year since the first wind farms of the 1980s.

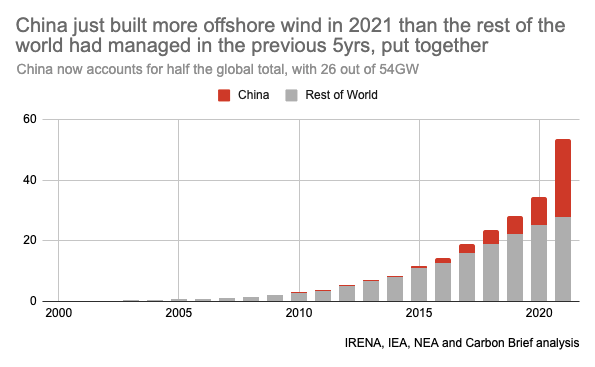

China has 50% of the global offshore wind, with 17GW added in 2021 alone to add to their existing 9GW. UK is 2nd and Europe 3rd. Many countries including USA and Australia have announced projects.

Why the Growth?

- Land tenure and leasing costs to owners reduced

- Much reduced community opposition

- Green field sites – no towns, farms, land clearing needed

- Simpler logistics – turbines assembled in size

- Ongoing reduction in cost (LCOE)

- More reliable and consistent wind making for better energy deliver profile

- Cross learning between offshore oil and gas drilling and floating offshore wind.

Macquarie will spin off its 15 gigawatt pipeline of offshore wind farms worldwide into a separate company. It is looking to diversify its capital sources and partners in pursuit of more projects. (AFR Feb 2022)

Offshore Wind Technology Impovements

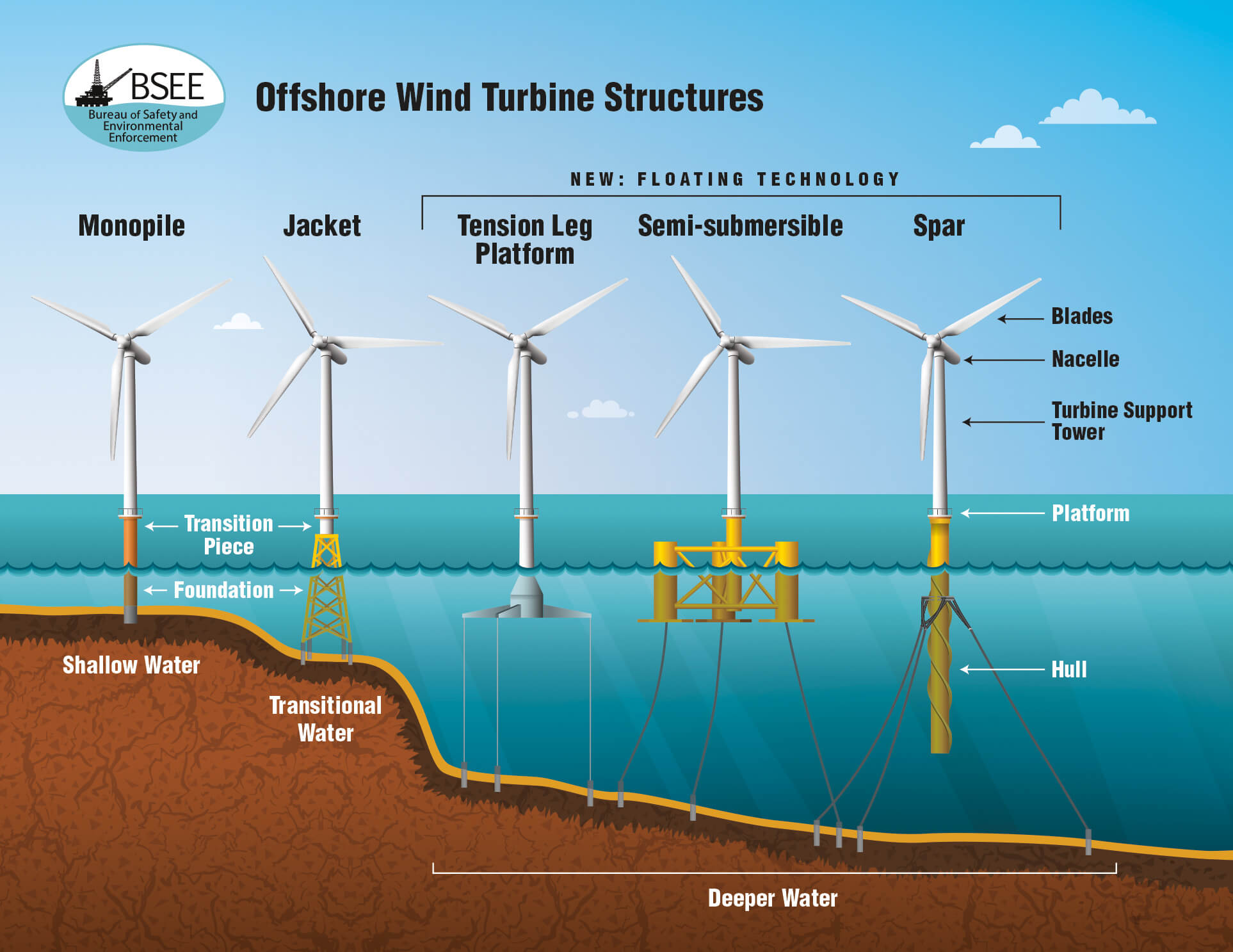

Onshore wind turbine size and efficiency have improved over years of engineering innovation. Off shore wind has also improved and there are multiple technologies. Floating offshore wind farms have a Levelized cost of energy (LCOE) of more than three times that of fixed-bottom wind farms. Commercial floating wind will arrive sometime near the end of this decade says the UK’s offshore renewable energy development agency (ORE Catapult). They expect the weighted average cost of capital to still be 30% higher than for fixed-bottom offshore farms. Technology from the oil and gas industry provides much experience and understanding.

Summary of Dogger Bank Off UK

Check out the Wikipedia and DoggerBank information and published data. Dogger Bank is 3 1.2GW farms. Cost of each is about $4 billion. Operating costs are not included. The capital costs are about 3 cents per kWh.

Offshore Announcements

| Country | Location | Amount (GW) | Year | Cost ($US-B) | Notes and links |

|---|---|---|---|---|---|

| China | Various | 9 | 2020 prior | China has 50% of offshore Forbes review 2022 | |

| China | Various | 17 | 2021 | Added 17 in 2021 | |

| Australia | Great Southern off Bass Strait AFR Feb 2022 | ||||

| USA | Macquari | ||||

| Scotland | Orkney | 2 | 7.3 | Macquarie in combo with Total Energies and RIDG ( | |

| Australia | Bass, TAS | 0.3 | 2026 | Nexsphase | |

| Australia | Bunbury | 2 | OceanX | ||

| Australia | CliffHead WA | 1.1 | Pilot Energy | ||

| Australia | Eden Offshore NSW | 2 | Ocean X | ||

| Australia | Seadragon | 1.5 | Flotation Energy | ||

| Australia | Spinifex, Portland Vic | 1 | Alinta | ||

| Australia | Star of South, Woodside, VIC | 2.2 | 2030 | 7 | Copenhagen Infrastructure |

| Australia | Ulladulla NSW | 1.8 | Ocean X | ||

| Australia | Portland Vic | 0.495 | AustralisEnergy | ||

| Australia | Binninguo WA | 0.3 | Australis Energy | ||

| Australia | Wollongong | 1.5 | 2030 | Bluefloat | |

| Australia | Great Southern | 1 | 2030 | Macquaried Green | |

| Australia | Greater Gippsland | 1.4 | Bluefloat | ||

| Australia | Hunter Coast | 1.5 | 2030 | Bluefloat | |

| Australia | Illawarra Port Kembla NSW | 2 | OceanX | ||

| Australia | Novacastrian, NSW | 2 | OceanX | ||

| Australia | SA Bight | 0.6 | Australis | ||

| Korea | Has 98 projects, 5 built, none operational. | ||||

| Korea | 3 | Equinor EMP Korean plans | |||

| Korea | 9 | Korea targets 12GW for offshore wind by 2030 and 60GW by 2034 | |||

| Taiwan | Macquarie Corio | ||||

| UK | Various | 10 | UK Renewable Energy Stats | ||

| Europe | Various | 15 | Data from IEA | ||

| Australia | Leuwin, WA | 3 | 2026 | Copenhagen Energy | Plans for WA Also in Philippines, Ireland, has 8GW |

Learnings from Oil and Gas

Latest Offshore Floating Windfarm

The latest venture is highlighted in Offshore.biz. The 88MW Hywind Tampen project off the Norwegian coast comprises 11 Siemens Gamesa 8 MW wind turbines installed on concrete SPAR-type floating foundations in water depths of between 260 and 300 metres.